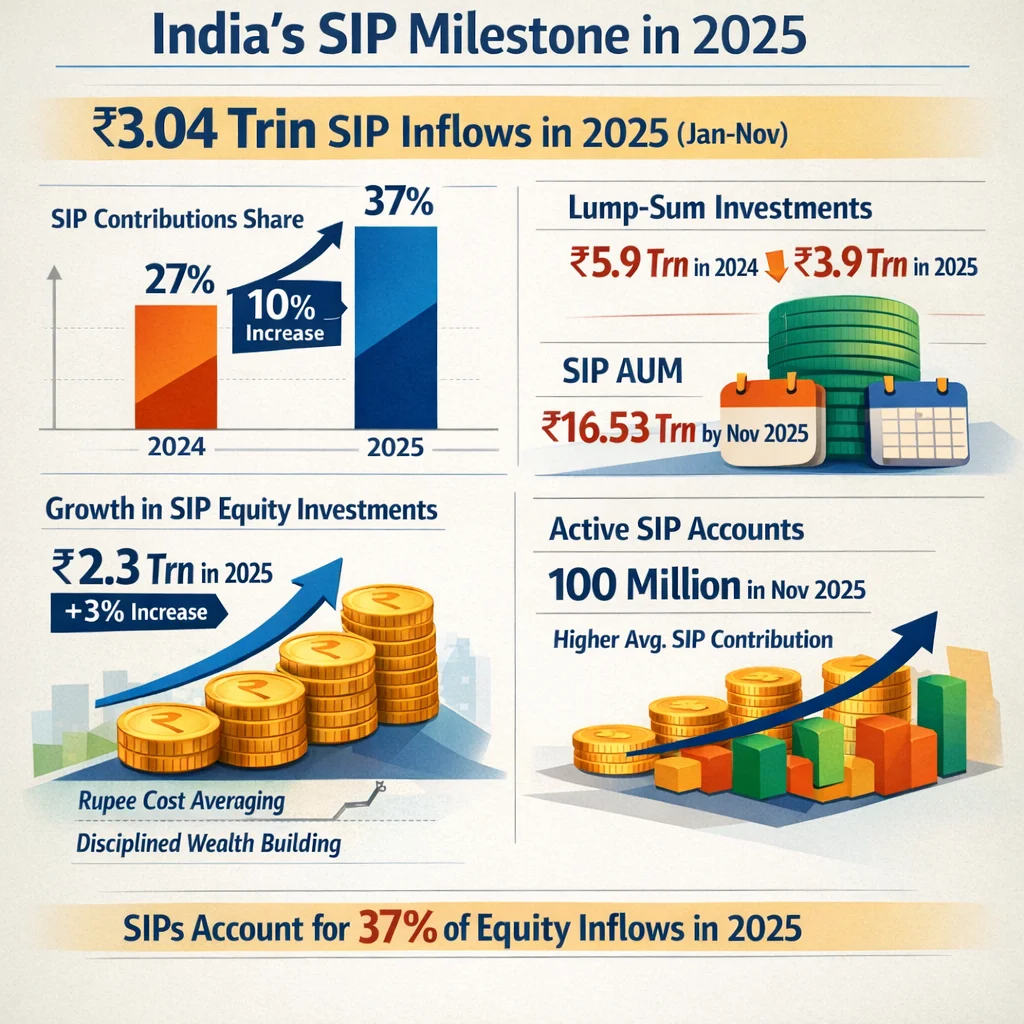

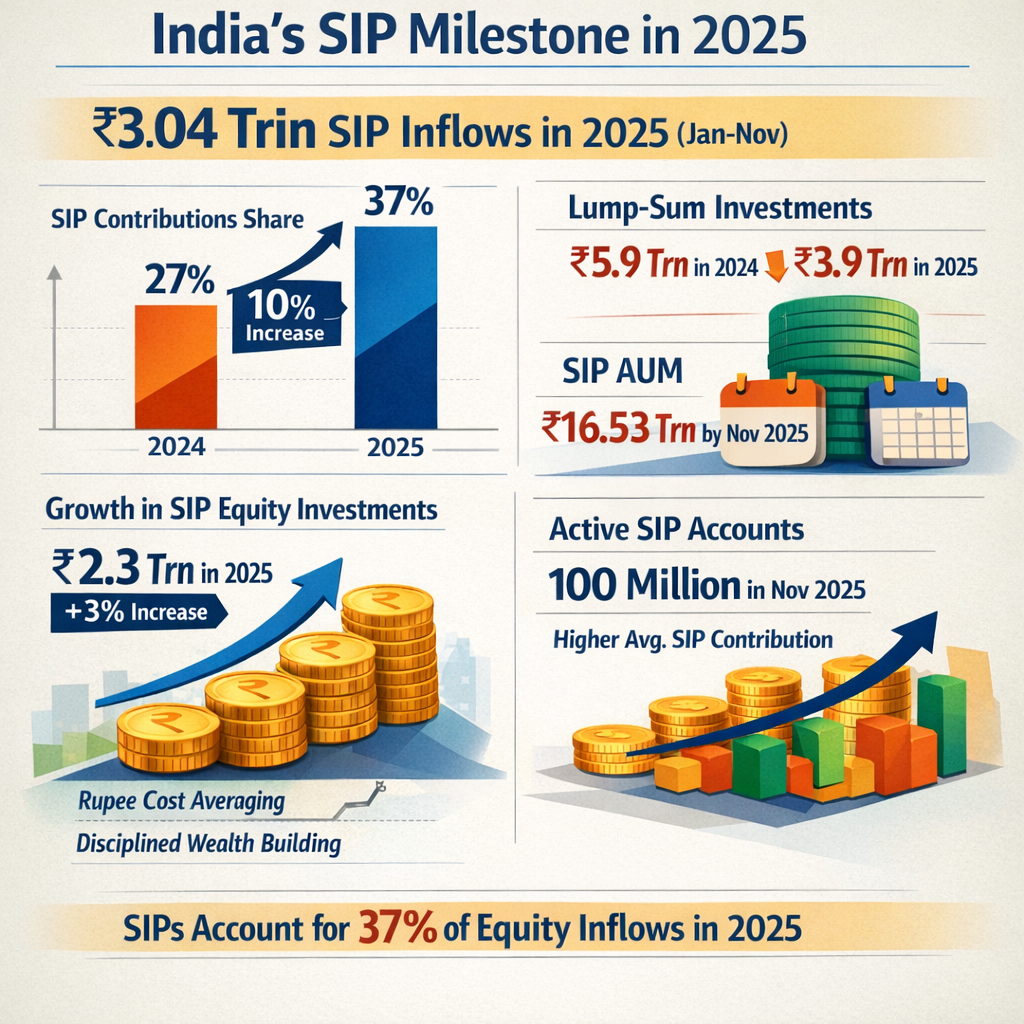

SIP Inflows Cross ₹3 Trillion in 2025: Systematic Investment Plans Dominate as Investors Avoid Lump-Sum Market Timing Risks

Systematic Investment Plan (SIP) inflows into mutual funds have achieved unprecedented milestone of ₹3.04 trillion in 2025 (through November), surpassing the entire year 2024's ₹2.69 trillion total and establishing SIPs as India's preferred long-term wealth-building investment vehicle amid market volatility and investor demand for disciplined, staggered investment approaches. The exceptional SIP growth—driven by investor preference for consistent monthly contributions reducing market timing risk and emotional decision-making—has fundamentally shifted mutual fund industry composition, with SIP investments now accounting for 37% of gross equity scheme inflows in 2025 compared to 27% in 2024, representing 10 percentage point share expansion within single year. Simultaneously, lump-sum investments in active equity schemes declined sharply to ₹3.9 trillion through October 2025 from ₹5.9 trillion in comparable 2024 period, establishing clear behavioral shift where investors increasingly favor systematic staggered contributions over opportunistic lump-sum market-timing strategies previously characterizing Indian retail investor behavior. SIP investments in active equity schemes specifically expanded 3% to ₹2.3 trillion despite market corrections, demonstrating remarkable resilience and counter-cyclical accumulation where investors increase contributions during market weakness rather than withdrawing. The SIP AUM (Assets Under Management) has reached ₹16.53 trillion by November 2025, representing more than 20% of mutual fund industry's total AUM and establishing SIPs as one of mutual fund sector's most powerful growth engines. While the absolute number of active SIP accounts declined from 103 million in December 2024 to 100 million in November 2025—primarily reflecting data cleanup exercises and market correction account inactivity—the remaining accounts demonstrate dramatically higher contribution discipline and commitment, with average SIP contribution amounts expanding significantly supporting aggregate flow increases despite account number decline. Industry analysts attribute SIP phenomenon to investor recognition that systematic regular investing disciplines emotional decision-making, enables rupee-cost averaging smoothing volatility impacts, and builds sustainable wealth accumulation aligned with retirement and life-goal planning rather than speculative market timing.

![India vs South Africa 1st T20I: Hardik Pandya's Explosive 59 Powers India to Victory in Cuttack [Match Report & Analysis]](assets/images/1765302958_im4.jpg)