Opening Week Performance: Breaking the Century Mark

Day-Wise Collection Breakdown and Holiday Weekend Impact

Avatar: Fire and Ash's opening week (December 25-31, 2025) demonstrated solid commercial performance characterized by strong opening weekend followed by typical weekday decline pattern and recovery during Christmas holiday period:

|

Day |

Collection (Net) |

Notable Factors |

|

Day 1 |

₹19 crores |

Christmas Day opening |

|

Day 2 |

₹22.5 crores |

Peak opening weekend |

|

Day 3 |

₹25.75 crores |

Opening weekend culmination |

|

Day 4 |

₹9 crores |

Post-weekend weekday decline |

|

Day 5 |

₹9.3 crores |

Continued weekday weakness |

|

Day 6 |

₹10.65 crores |

Mid-week stabilization |

|

Day 7 |

₹13.3 crores |

Holiday recovery (24.88% jump) |

|

Total |

₹109.45 crores net |

Exceeded ₹100 crore milestone |

The opening day collection of ₹19 crores net reflected moderate performance for Hollywood tentpole release on Christmas Day, a day typically providing substantial theatrical advantages through holiday leisure availability and family entertainment seeking. However, the collection appeared constrained by competing entertainment options and potential audience splitting with Bollywood's Dhurandhar and other concurrent releases.

Opening weekend cumulative collection (Days 1-3: ₹67.25 crores net) suggested reasonable commercial traction for science fiction spectacle, though below blockbuster thresholds typical for Avatar franchise installments. The three-day weekend represented approximately 61% of seven-day total, indicating substantial back-loaded collection dependency on holiday period extensions.

The dramatic weekday decline (Day 4-5 collections of ₹9 crores each—approximately 35% below opening day)—reflected typical post-weekend box office patterns where casual audiences return to regular schedules and entertainment consumption returns to baseline levels. However, Day 7's substantial recovery (₹13.3 crores, 24.88% increase from Day 6) indicated renewed audience interest capitalizing on Christmas holiday extension and New Year approach.

Official Poster for 'Avatar: Fire and Ash' : r/movies

Avatar: Fire and Ash (2025) - IMDb

![]()

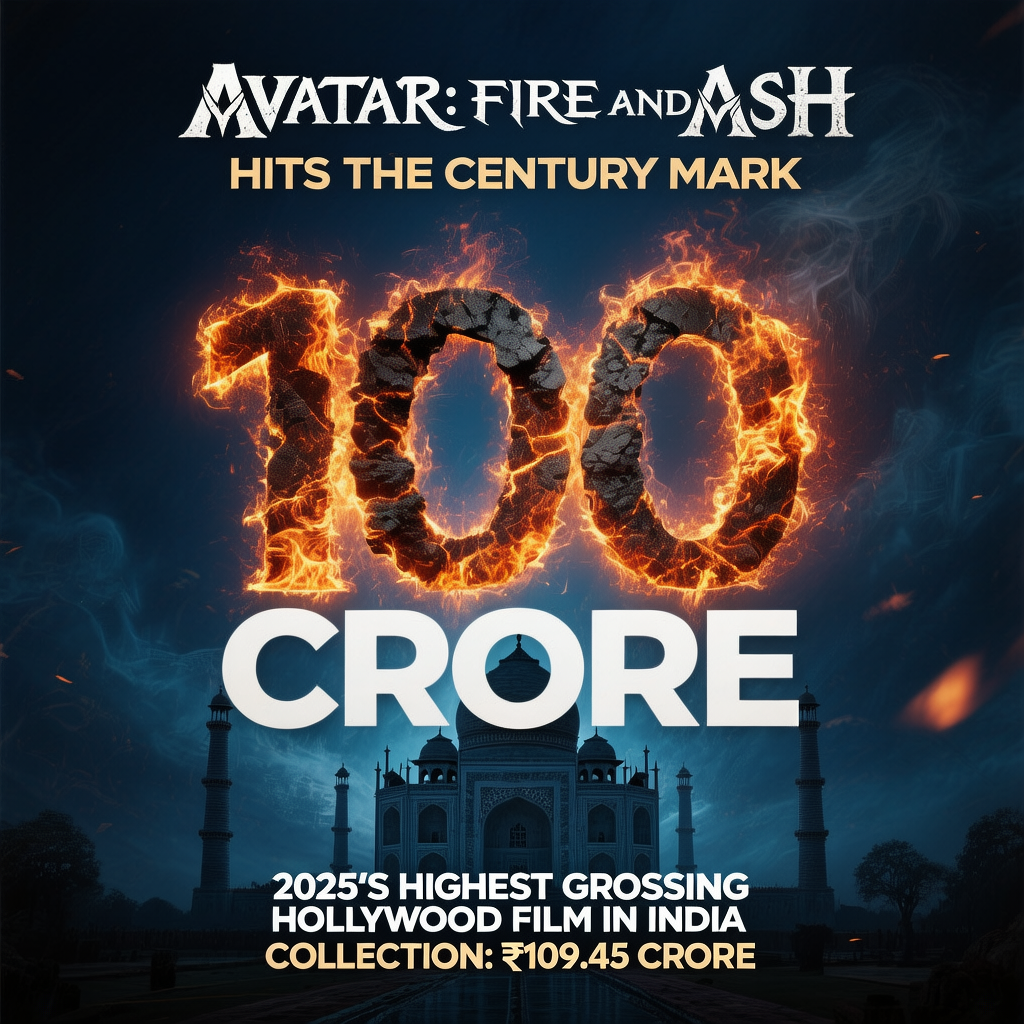

Highest-Grossing Hollywood Film of 2025 in India: Market Dominance

Surpassing Hollywood Competition: Mission Impossible and Beyond

Avatar: Fire and Ash's ₹109.45 crore seven-day collection positioned it as 2025's highest-grossing Hollywood release at the Indian box office, surpassing five significant competitors and establishing clear commercial dominance within Western cinema segment:

2025's Top 5 Highest-Grossing Hollywood Films in India (Net Collections):

1. Avatar: Fire and Ash – ₹109.45 crores (7 days)

2. Mission: Impossible – The Final Reckoning – ₹100.56 crores (lifetime)

3. F1 – ₹102.82 crores (lifetime)

4. Jurassic World Rebirth – ₹100.56 crores (lifetime)

5. The Conjuring: Last Rites – ₹82.11 crores (lifetime)

The competitive displacement demonstrates Avatar franchise's exceptional theatrical appeal and audience drawing power within Indian cinema market, despite industry challenges affecting Hollywood releases globally. Mission: Impossible - The Final Reckoning, which achieved ₹100.56 crore lifetime collection after extended theatrical run, fell short of Avatar's accelerated trajectory, indicating Fire and Ash's stronger audience resonance and commercial magnetism.

F1 and Jurassic World Rebirth—both franchise entries with established global recognition—generated substantial collections (₹102.82 and ₹100.56 crores respectively), yet Avatar: Fire and Ash achieved comparable or superior performance in compressed timeframe, suggesting superior initial momentum and opening week audience enthusiasm.

The Conjuring: Last Rites (₹82.11 crores) represented lower-performing entry within horror-thriller segment, reflecting genre-specific challenges and narrower audience appeal compared to science fiction spectacles or action franchises.

2025 Hollywood Global Box Office YTD : r/boxoffice

Summer Box Office 2025 Gets Clobbered As Overseas Grosses Fall

Domestic Box Office 2025 (Weekend 2) : r/boxoffice

![]()

Avatar Franchise at Indian Box Office: Comparative Analysis

The Way of Water's Exceptional Performance and Franchise Trajectory

Avatar: The Way of Water established extraordinary commercial benchmark at Indian box office with lifetime collection of ₹390.6 crores net—representing unassailable franchise peak and demonstrating extraordinary audience appetite for Avatar universe expansion. The second installment's collection magnitude—substantially exceeding Fire and Ash's current trajectory and approaching four-fold return—reflects multiple contributing factors: expanded theatrical distribution, word-of-mouth momentum, and exceptional visual spectacle demand for immersive 3D cinema experience.

The Way of Water's ₹390.6 crore achievement positioned it among India's highest-grossing Hollywood releases of all time, demonstrating Avatar franchise's exceptional appeal to Indian audiences and the region's strategic importance to global Hollywood box office economics. The massive collection justified substantial production investment (estimated $250+ million globally) and established franchise as bankable tentpole capable of generating extraordinary returns.

The Original Avatar's Enduring Legacy and Fire and Ash's Position

The original Avatar (2009), James Cameron's revolutionary science fiction film that pioneered 3D cinema technology and transformed global cinema landscape, achieved ₹141.25 crore net at Indian box office. This collection—substantial by 2009 standards and remarkable for non-franchise, original intellectual property film—established Avatar as cultural phenomenon transcending typical Hollywood releases' theatrical appeal.

Fire and Ash's current ₹109.45 crore collection (7 days) positions it below the original Avatar's ₹141.25 crore lifetime total, establishing the third installment as franchise's lowest-grossing theatrical entry in Indian market. This performance hierarchy—Way of Water > Original Avatar > Fire and Ash—reflects various factors: sequel fatigue, theater allocation preferences toward Dhurandhar and Bollywood releases, and general Hollywood theatrical challenges during 2025.

Projected Trajectory: Can Fire and Ash Surpass Original Avatar?

Industry analysts project Avatar: Fire and Ash will likely surpass the original Avatar's ₹141.25 crore collection during extended New Year holiday period (December 28-January 5), benefiting from continued festive season theatrical attendance and absence of significant competitive releases during year-end festivities. Current seven-day performance suggests momentum toward surpassing original Avatar's lifetime collection within 10-12 day period.

Achieving ₹150+ crore lifetime collection would position Fire and Ash as respectable franchise entry, though remaining substantially below The Way of Water's extraordinary ₹390.6 crore benchmark. The performance differential between franchise installments reflects industry dynamics, competitive release calendars, and evolving audience preferences regarding science fiction spectacle versus alternative entertainment options.

The Way of Cameron - On 'Avatar: The Way of Water' - Film Cred

Highest Ticket-Selling Hollywood Films at the Indian Box ...

Avatar | 20th Century Studios

![]()

Competition with Bollywood's Dhurandhar: Cross-Genre Box Office Dynamics

Navigating Dhurandhar's Market Dominance

Avatar: Fire and Ash's opening week performance occurred amid intense competition from Bollywood's action thriller Dhurandhar, which captured substantial market share and dominated Indian theatrical landscape during December 25-31 period. The competitive environment significantly constrained Avatar's collection potential, particularly among Hindi-speaking regions where Dhurandhar maintained cultural relevance and demographic appeal.

Dhurandhar's concurrent release created screen allocation challenges: multiplexes distributed limited screen availability between competing releases, constraining Avatar's theatrical footprint and audience accessibility. The competition particularly impacted opening weekend collections, where audience prioritization typically favors culturally proximate releases (Hindi cinema for Hindi-speaking regions, regional cinema for respective regions).

However, Avatar: Fire and Ash demonstrated resilience by achieving century collections despite Dhurandhar competition, indicating strong international release appeal and substantial Western cinema demand within Indian market. The film's performance among English-speaking urban audiences and multiplexes (where Hollywood films traditionally maintain stronger theatrical presence) offset potential Hindi market constraints.

![]()

3D Immersive Cinema Experience: Technological Advantage

Avatar Franchise's 3D Technology Legacy

The Avatar franchise fundamentally transformed cinema through advanced 3D cinematography and immersive visual technology that continues distinguishing franchise entries from conventional theatrical experiences. James Cameron's continuous technological innovation—establishing Avatar films as showcase for cinema's cutting-edge visual capabilities—provides inherent theatrical advantage over traditionally-shot films.

Avatar: Fire and Ash's theatrical appeal significantly derives from 3D spectacle experience unavailable through alternative viewing platforms, incentivizing theatrical attendance despite streaming competition and alternative entertainment options. The immersive visual experience justifies premium ticket pricing and encourages repeat theatrical visits from audiences valuing technological innovation and visual grandeur.

Indian audiences—particularly in urban multiplexes equipped with advanced 3D projection technology—demonstrate sustained enthusiasm for immersive visual experiences, explaining Avatar franchise's exceptional theatrical performance within Indian market. The technology-driven appeal provides Avatar films competitive advantage against conventional Hollywood releases lacking sophisticated visual differentiation.

Tom Cruise Returns for 'Mission: Impossible - The Final ...

Mission: Impossible - The Final Reckoning (2025) - IMDb

![]()

Hollywood Films in India: 2025 Market Dynamics

Changing Box Office Landscape for Western Cinema

Avatar: Fire and Ash's dominant position among 2025 Hollywood releases reflects broader pattern of selective Western cinema success within Indian theatrical market, where specific franchise properties (Marvel, Avatar, Mission: Impossible) maintain significant audience appeal while original films and lesser-known properties struggle. The franchise-dependent pattern indicates Indian audiences increasingly prioritize established intellectual property with recognizable character universes and narrative continuities.

Franchise Appeal and Audience Preferences

Mission: Impossible franchise's ₹100.56 crore collection, despite featuring established action star Tom Cruise and franchise pedigree, fell short of Avatar's momentum, suggesting science fiction spectacle maintains competitive advantage over traditional action-thriller narratives. The performance hierarchy indicates audience preference variance by genre, with science fiction spectacle (Avatar), action franchises (Mission: Impossible), and adventure properties (Jurassic World) maintaining differentiated appeal levels.

The Conjuring horror franchise's ₹82.11 crore collection (lowest among top 5 performers) suggests horror-thriller genre faces headwinds in Indian theatrical market, either through cultural preferences, streaming competition, or audience demographic shifts. The genre-specific performance variation reflects nuanced audience segmentation and preference patterns transcending simple Hollywood versus Bollywood binary.

![]()

Future Trajectory and Extended Holiday Performance Projections

New Year Holiday Period Opportunity

Avatar: Fire and Ash's trajectory during January 1-5 period (New Year holidays) will prove critical for determining ultimate lifetime collection ceiling, with projections suggesting potential ₹140-160 crore net achievement depending on weekday performance maintenance and continued holiday attendance patterns. The extended holiday period provides theatrical revenue opportunity absent during typical weekday exhibition.

Week 2 performance (January 2-8) will indicate whether Fire and Ash maintains sufficient audience momentum to achieve sustained collections or experiences typical second-week decline patterns associated with opened films. Achieving ₹15+ crore daily collections during holiday extended weekdays would indicate extraordinary audience retention and position film toward upper projection ranges.

Lifetime Collection Projections

Conservative projections estimate Avatar: Fire and Ash lifetime collection of ₹150-170 crore net, positioning it above original Avatar (₹141.25 crores) and establishing respectable franchise entry despite lower-than-anticipated opening performance relative to The Way of Water's exceptional ₹390.6 crore collection. Achieving this projection range would still represent significant commercial success and validate Avatar franchise's continued theatrical viability in Indian market.

![]()

Conclusion: Avatar: Fire and Ash Establishes 2025 Hollywood Dominance

Avatar: Fire and Ash's achievement of ₹109.45 crore net collection within seven days—crossing the century mark and establishing itself as 2025's highest-grossing Hollywood release in India—represents significant commercial milestone validating franchise's continued theatrical appeal despite opening week challenges and competitive market environment. The film's dominance over other Hollywood releases (Mission: Impossible, F1, Jurassic World Rebirth, The Conjuring) establishes clear market leadership within Western cinema segment.

The opening week performance trajectory—characterized by strong opening weekend followed by typical weekday decline and recovery during Christmas holidays—reflects predictable theatrical patterns while establishing positive momentum toward extended theatrical run and ultimate lifetime collection achievement. The Day 7 recovery (24.88% jump to ₹13.3 crores) indicates sustained audience interest and holiday period capitalization potential.

As Avatar: Fire and Ash progresses toward second-week exhibition and New Year holiday extended period, industry analysts project continued performance improvement positioning film toward ₹150-170 crore lifetime collection range, potentially surpassing original Avatar's ₹141.25 crore benchmark and establishing second-highest Avatar franchise entry at Indian box office behind The Way of Water's exceptional ₹390.6 crore performance.

For global Hollywood cinema, Avatar: Fire and Ash's Indian theatrical success demonstrates continued franchise appeal and immersive 3D technology's sustained theatrical viability despite streaming platform expansion and changing entertainment consumption patterns. The film's performance validates James Cameron's continued creative vision and Avatar franchise's enduring commercial viability as premium theatrical experience justifying premium pricing and immersive cinema infrastructure investment.**

![]()

Citations:

Koimoi - Avatar: Fire And Ash India Box Office Day 7: Hits A Century, Becomes 2025's Highest-Grossing Hollywood Film In India (2025); Box office tracking data - Day-wise collection breakdown and comparative analysis; IMDb - Avatar: Fire and Ash (2025) film details; IMDb - Avatar franchise filmography and box office performance; Indian cinema analysts - Hollywood film performance in Indian market; Box office tracking services - 2025 Hollywood releases performance comparison (Mission: Impossible, F1, Jurassic World Rebirth, The Conjuring); Avatar franchise box office history - Indian market performance data; James Cameron filmography - Avatar film series box office analysis

Post your opinion

No comments yet.