Business

Business

SIP Inflows Cross ₹3 Trillion in 2025: Systematic Investment Plans Dominate as Investors Avoid Lump-Sum Market Timing Risks

Systematic Investment Plan (SIP) inflows into mutual funds have achieved unprecedented milestone of ₹3.04 trillion in 2025 (through November), surpassing the entire year 2024's ₹2.69 trillion total and establishing SIPs as India's preferred long-term wealth-building investment vehicle amid market volatility and investor demand for disciplined, staggered investment approaches. The exceptional SIP growth—driven by investor preference for consistent monthly contributions reducing market timing risk and emotional decision-making—has fundamentally shifted mutual fund industry composition, with SIP investments now accounting for 37% of gross equity scheme inflows in 2025 compared to 27% in 2024, representing 10 percentage point share expansion within single year. Simultaneously, lump-sum investments in active equity schemes declined sharply to ₹3.9 trillion through October 2025 from ₹5.9 trillion in comparable 2024 period, establishing clear behavioral shift where investors increasingly favor systematic staggered contributions over opportunistic lump-sum market-timing strategies previously characterizing Indian retail investor behavior. SIP investments in active equity schemes specifically expanded 3% to ₹2.3 trillion despite market corrections, demonstrating remarkable resilience and counter-cyclical accumulation where investors increase contributions during market weakness rather than withdrawing. The SIP AUM (Assets Under Management) has reached ₹16.53 trillion by November 2025, representing more than 20% of mutual fund industry's total AUM and establishing SIPs as one of mutual fund sector's most powerful growth engines. While the absolute number of active SIP accounts declined from 103 million in December 2024 to 100 million in November 2025—primarily reflecting data cleanup exercises and market correction account inactivity—the remaining accounts demonstrate dramatically higher contribution discipline and commitment, with average SIP contribution amounts expanding significantly supporting aggregate flow increases despite account number decline. Industry analysts attribute SIP phenomenon to investor recognition that systematic regular investing disciplines emotional decision-making, enables rupee-cost averaging smoothing volatility impacts, and builds sustainable wealth accumulation aligned with retirement and life-goal planning rather than speculative market timing.

Business

Business

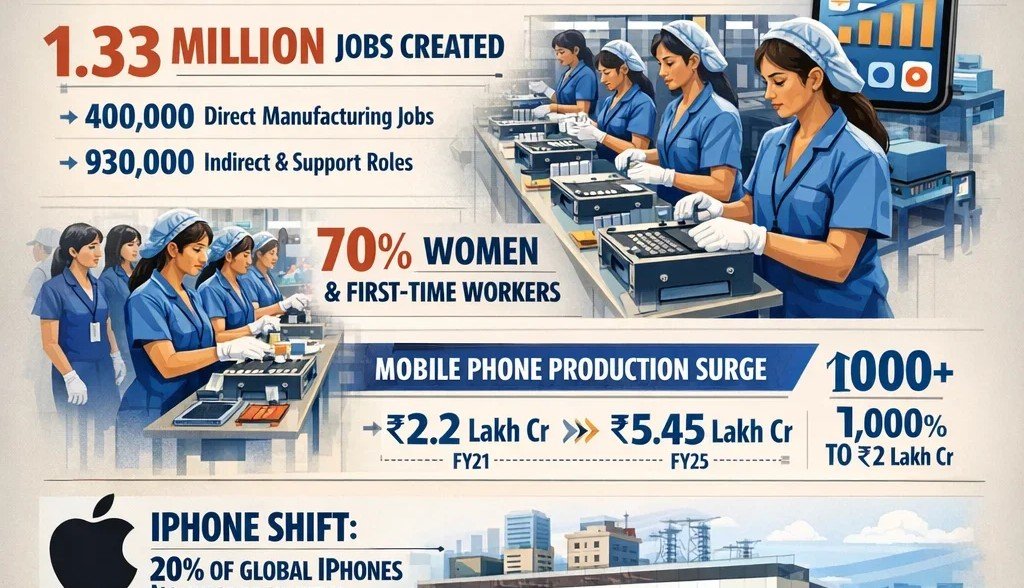

Make in India Electronics: 1.33 Million Jobs Created as PLI Scheme Transforms Smartphone Manufacturing and Exports

India's electronics manufacturing sector, powered by the Production Linked Incentive (PLI) scheme launched in October 2020, has achieved extraordinary job creation milestone of 1.33 million positions—comprising approximately 400,000 direct manufacturing jobs and 930,000 indirect positions across ancillary industries, logistics, and services—with remarkable gender inclusion where nearly 70% of job additions involved women and first-time workers entering formal employment. Mobile phone production has surged 148% from ₹2.2 lakh crore in FY21 to over ₹5.45 lakh crore in FY25, while exports have appreciated nearly 1,000% to exceed ₹2 lakh crore during the same period, establishing India as emerging global smartphone manufacturing powerhouse challenging Chinese dominance. The job creation achievement directly reflects Apple's strategic shift of iPhone manufacturing from China to India, with over 20% of global iPhones now manufactured domestically, supported by contract manufacturers Foxconn, Pegatron, and Tata Electronics establishing massive production facilities in Tamil Nadu, Karnataka, and other states with world-class infrastructure, on-premises boarding, women's housing, and dedicated transportation supporting workforce of unprecedented scale. In FY25 alone, mobile phone manufacturing ecosystem paid approximately ₹25,000 crore in wages to blue-collar staff, with direct employees earning average ₹18,000 monthly salary and indirect workers receiving ₹14,000 monthly compensation, establishing high-wage employment opportunity transcending traditional low-skill manufacturing perception. Women represent disproportionate beneficiary of electronics manufacturing expansion, with Foxconn's new iPhone assembly facility near Bengaluru hiring 30,000 workers (80% female), establishing women-led manufacturing model demonstrating technology sector inclusivity and breaking gender barriers in high-technology production. India's smartphone product category has ascended from 167th position in FY15 to 2nd largest export category in FY25, with industry projections indicating India will become world's second-largest mobile phone exporter during 2026, trailing only China and establishing manufacturing capability comparable to global leaders. The PLI scheme's 1:3 direct-to-indirect job ratio aligns precisely with government projections, validating policy framework effectiveness and establishing template for subsequent manufacturing incentive schemes targeting automotive, electronics, and other sectors requiring domestic supply chain development and export competitiveness.

Business

Business

IndiGo Flight Disruptions: DGCA Panel Submits Confidential Probe Report on Operational Collapse and Crew Management Failures

The Directorate General of Civil Aviation (DGCA) submitted a confidential panel report on December 25, 2025 regarding IndiGo's catastrophic operational collapse that resulted in cancellation of over 4,200 flights between December 1-9 and left hundreds of thousands of passengers stranded nationwide, with the four-member inquiry committee led by DGCA Joint Director General Sanjay K Bramhane determining that the airline failed to adequately prepare for Flight Duty Time Limitation (FDTL) regulations that took effect November 1, 2025. The unprecedented scale of disruptions—with IndiGo canceling approximately 25% of its 17,404 scheduled domestic flights while maintaining only 2.4% international flight cancellations—established clear pattern demonstrating catastrophic domestic operational failure rooted in crew management deficiencies and systematic planning gaps. Prime factors identified in the investigation include: IndiGo's complete failure to accurately forecast pilot crew requirements under the revised FDTL norms despite DGCA providing repeated advance notice and directives; systematic inability to conduct timely pilot training and roster realignment despite regulatory warnings; breakdown of operations control center functionality during peak disruption period; deterioration of trust between Indian pilots and expatriate management regarding safety and operational protocols; and absence of adequate internal oversight mechanisms ensuring regulatory compliance and operational preparedness. The DGCA's pre-investigation order noted that India's largest airline (commanding approximately 65% domestic market share) demonstrated "deficiencies in internal oversight, operational preparedness, and compliance planning," with the actual crew requirement under new FDTL rules exceeding what IndiGo had anticipated, directly precipitating the cascade of 170-200 daily cancellations and network-wide disruptions. Government action likely to follow the confidential report submission includes potential withdrawal of the airline's accountable manager's approval, exemplary fines establishing regulatory precedent, possible suspension of operational approvals, management accountability measures, and potential criminal referrals if negligence findings prove sufficiently severe. The DGCA has already taken decisive interim action including sacking four flight operations inspectors responsible for IndiGo oversight (representing unprecedented regulatory internal accountability), deploying permanent oversight teams at IndiGo's Gurugram headquarters to monitor daily crew utilization and passenger refund compliance, ordering mandatory 10% operational schedule reduction (eliminating 220+ daily flights), and granting temporary exemption from certain FDTL night operation restrictions through February 10, 2026 to prevent further destabilization. The crisis has exposed systemic regulatory oversight gaps regarding airline operational preparedness assessments, with IndiGo CEO Pieter Elbers and COO Isidre Porqueras receiving show-cause notices requiring explanation for management failures and potential personal accountability.

Business

Business

Stock Market Top Gainers and Losers December 26, 2025: Titan Surges 2.17%, TCS and Shriram Finance Decline Amid FII Outflows

Indian equity markets closed in negative territory on December 26, 2025, with the 30-share BSE SENSEX declining 367.25 points (0.43%) to 85,041.45 and the 50-share NSE NIFTY50 falling 99.80 points (0.38%) to 26,042.30, driven by foreign institutional investor (FII) outflows of ₹1,993.18 crore despite positive domestic institutional investor (DII) inflows of ₹2,531.65 crore, with key losses in Asian Paints (-1.4%), Shriram Finance (-1.37%), Bajaj Finance (-1.30%), and TCS (-1.27%). Titan Company emerged as the dominant gainer, surging 2.17% to touch a 52-week high of ₹4,006.90 per share following entry into lab-grown diamonds segment under brand "beYon," supported by precious metals strength with gold and silver rallying to fresh record highs, establishing momentum for jewelry retail sector. The NIFTY Midcap 100 index declined 0.23% or 136.90 points to 60,314.45, weighed down by technology stocks including Coforge (-3.67% ahead of fundraising board meeting), Dixon Technologies (-2.76%), and Motilal Oswal Financial Services (-2.75%), while NIFTY Smallcap 100 fell 0.08% or 13.50 points to 17,695.10, with significant losses in Reliance Power (-3.96%) and JBM Auto (-3.74%). Railway sector stocks demonstrated exceptional strength with Rail Vikas Nigam surging 12.02% following government announcement of new railway fares, supported by gains in Indian Railway Catering and Tourism Corporation (3.95%), National Aluminium Company (3.49%), and Container Corporation of India (2.15%), reflecting infrastructure sector optimism. Smallcap gainers highlighted commodity-driven outperformance with Hindustan Copper soaring 9.09% as copper futures reached lifetime highs domestically and internationally, alongside strong performances in Karur Vysya Bank (5.36%), NBCC (5.29%), and Ircon International (4.42%), demonstrating selective sector strength despite broader market weakness. The market divergence—with largecap weakness, midcap decline, and smallcap resilience driven by sector-specific catalysts—reflects cautious investor sentiment ahead of year-end positioning and global monetary policy uncertainties, with capital flows favoring quality defensive stocks and infrastructure-linked businesses over speculative midcap and smallcap names lacking near-term catalysts.

Business

Business

Elon Musk Silver Price Concerns: China's New Export Rules Threaten Global Supply and Tesla's Production

Tesla CEO Elon Musk publicly expressed serious concerns regarding soaring silver prices, warning that rising costs represent a significant threat to industrial manufacturing across multiple technology sectors including electric vehicles, solar panels, and electronics, amid China's announced January 1, 2026 export restrictions that will require silver exporters to obtain government licenses and maintain minimum production thresholds. Silver prices surged to an all-time record high of $78.65 per ounce on December 26, 2025, driven by structural supply deficits continuing for five consecutive years, physical inventory collapses across major trading hubs, and anticipatory purchasing ahead of China's restrictive export licensing requirements blocking small and mid-sized exporters. Musk's public statement—"This is not good. Silver is needed in many industrial processes"—highlighted genuine concern that proposed Chinese restrictions could exacerbate existing global supply shortages by blocking approximately 60-70% of global silver supply through licensing mechanisms requiring minimum 80 tonnes annual production and $30 million credit line qualifications accessible only to large state-approved firms. The structural supply deficit encompasses 100-250 million ounce annual gap between global demand (1.24 billion ounces in 2025) and supply (1.01 billion ounces), with silver mining constrained by byproduct limitations (70% derived from copper/zinc mining), extended 10+ year mine development timelines, declining ore quality, and insufficient recycling capacity to address shortfalls. Physical silver inventories have collapsed dramatically: COMEX holdings declined 70% since 2020, London vaults fell 40%, and Shanghai inventories reached 10-year lows, creating regional physical scarcity where some areas maintain only 30-45 days of usable silver at current demand rates, with Shanghai physical silver commanding $80+ per ounce versus lower COMEX prices, reflecting extreme premium for actual metal access. The paper-to-physical silver ratio has diverged to approximately 356:1, indicating extreme disconnect between paper silver contracts (356 ounces of claims) and physical metal (1 ounce actual), creating systemic vulnerability if physical delivery requests surge beyond available inventory levels. Industrial silver demand represents 50-60% of total consumption, with solar panels, electric vehicles, medical devices, and electronics requiring silver as irreplaceable conductor and contact material, ensuring genuine industrial purchasing power sustains prices even without speculative investment demand.

Business

Business

Gold Rate Today in India: 24-Karat and 22-Karat Gold Prices Across Major Cities (December 27, 2025)

Gold prices in India reached fresh all-time record highs on December 27, 2025, with 24-karat gold trading at ₹140,290 per 10 grams and 22-karat gold at ₹128,599 per 10 grams as safe-haven asset demand accelerated amid Federal Reserve interest-rate reduction expectations and persistent geopolitical uncertainties. MCX (Multi-Commodity Exchange) gold futures for February 2026 contract closed at ₹139,940 per 10 grams, up ₹67 from the previous session's ₹139,873 per 10 grams, establishing continuous record-breaking performance throughout December 2025. The record-high breakthrough reflects broader precious metals rally driven by weakening US dollar, anticipated Federal Reserve rate cuts in January 2026, elevated global debt levels supporting inflation-hedge demand, and multiple regional geopolitical tensions creating safe-haven asset appetite. City-wise gold price variations across India demonstrate regional pricing differences reflecting local demand patterns, jeweler margins, and transportation costs, with 24-karat gold ranging from ₹139,790 per 10 grams in Mumbai to ₹140,440 per 10 grams in Chennai, while 22-karat gold ranges from ₹128,141 in Mumbai to ₹128,737 in Chennai. Retail gold prices in Indian jewelry markets remain substantially higher than MCX spot prices, with jewelers adding making charges (typically 5-15% depending on design complexity), hallmarking fees, GST (Goods and Services Tax at 5%), and other service charges that collectively increase effective purchase prices by 10-20% relative to pure gold commodity prices. The sustained gold price strength through 2025—culminating in December record highs—reflects fundamental recognition of gold's role as essential portfolio diversification asset, inflation hedge, geopolitical risk insurance, and ultimate store of value independent of any particular currency or political system.

Business

Business

BMW F 450 GS India Launch 2026: Complete Specifications, Price, and Adventure Motorcycle Details

The BMW F 450 GS, BMW Motorrad's highly-anticipated entry-level adventure motorcycle, is confirmed to launch in India in early 2026 (likely January-February) as the spiritual successor to the discontinued G 310 GS, with deliveries expected by late February 2026, following revised plans abandoning the India Bike Week 2025 debut. The German-made adventure bike will be manufactured locally at TVS Motor Company's Hosur facility in Tamil Nadu through an established BMW-TVS partnership, enabling aggressive pricing expected at ₹4.5-5.5 lakh ex-showroom, positioning the motorcycle competitively against the KTM 390 Adventure (₹3.95 lakh), Royal Enfield Himalayan 450 (₹3.06 lakh), and Honda NX500 (₹6.33 lakh). Powering the F 450 GS is a completely new 420cc parallel-twin liquid-cooled engine producing 48 horsepower at 8,750 rpm and 43 Newton-meters of torque at 6,750 rpm, featuring a unique 135-degree crankshaft offset that BMW claims delivers characterful riding while minimizing vibrations—making it one of the most powerful and refined twin-cylinder engines in the A2-category segment. The motorcycle will be offered in four international variants—Basic, Exclusive, Sport, and GS Trophy—with feature differentiation across electronic rider aids, suspension adjustability, heated grips, premium TFT display integration, and optional accessories, though BMW India's final variant strategy remains unconfirmed. Official and unofficial pre-bookings have commenced at select BMW dealerships across India with booking amounts ranging from ₹10,000-₹50,000, establishing strong pre-launch demand and indicating market confidence in the middleweight adventure motorcycle segment. Technical highlights include a steel tubular trellis frame, KYB USD front forks with 180mm travel, mono-shock rear suspension with progressive damping, dual-channel ABS with cornering capability, traction control, multiple riding modes (Rain, Road, Enduro, and optional Enduro Pro), innovative Easy Ride Clutch technology eliminating manual clutch requirement for urban riding, 6.5-inch TFT color display with Bluetooth connectivity, heated grips, and a lightweight 178kg kerb weight enabling spirited performance and aggressive handling characteristics.

Business

Business

Best Stocks to Buy for Long-Term Investment in 2026: Analyst Recommendations Across Largecap, Midcap, and Smallcap Segments

Leading Indian brokerages including Axis Securities, Geojit, BNP Paribas, Emkay, Motilal Oswal, and ICICI Securities have released comprehensive stock recommendations for 2026, emphasizing largecap quality stocks while maintaining selective caution regarding midcap and smallcap valuations, with preferred sectors encompassing banking, consumption, capital goods, infrastructure, IT services, and automobiles. Axis Securities identifies State Bank of India (SBI), Varun Beverages, Hindalco Industries, Nippon Life India Asset Management, Dalmia Bharat, Astral, Affle 3i, Healthcare Global Enterprises, and Mold-Tek Packaging as key picks for 2026, highlighting structural growth opportunities aligned with cyclical recovery. Technical analyst recommendations from Bonanza predict 5 largecap stocks—Bharti Airtel, Larsen & Toubro (L&T), Tata Consumer Products, Varun Beverages, and Hindustan Petroleum (HPCL)—could deliver 20% returns from current price levels, with specific upside targets including L&T at ₹4,320 and Bharti Airtel at ₹2,580. The 2025 equity market performance reveals fundamental divergence across market segments: largecap Nifty 50 and Nifty 100 indices surged 11% and 9% respectively, while broader Nifty 500 advanced 6.7%, Nifty MidCap declined 5.6%, and Nifty SmallCap 250 fell 6.7%—demonstrating pronounced largecap outperformance and valuation deterioration in broader market segments. Motilal Oswal projects 2026 as year of earnings recovery and consolidation, recommending quality largecap focus given Nifty MidCap-100 trading at 28.3x P/E (30% premium to long-term average) and Nifty SmallCap-100 at 25.9x P/E (70% premium), establishing selective investment approach emphasizing fundamentals over broad-based exposure. Expert outlook anticipates fiscal support, improved corporate earnings, rate cuts, increased government capital expenditure, and structural growth drivers supporting domestic consumption, infrastructure investment, and renewable energy deployment throughout 2026.

Business

Business

Silver Price Forecast 2026: 57% of Retail Investors Expect Triple-Digit Prices as Experts Debate $100 Per Ounce Milestone

A Kitco News survey reveals that 57% of retail investors expect silver to trade above $100 per ounce during 2026, reflecting extraordinary confidence in precious metals appreciation despite mainstream analyst consensus forecasting significantly more conservative $50-$65 price targets. Silver surged approximately 120% in 2025, with spot prices reaching record highs near $75 per ounce, substantially exceeding analyst consensus estimates from early 2025 that projected silver at $33-$42 per ounce, demonstrating powerful retail investor demand and persistent supply deficits driving actual price performance far beyond professional forecasts. A minority of prominent market commentators—including Peter Schiff, Keith Neumeyer (First Majestic Mining CEO), GoldSilver Lead Analyst Alan Hibbard, and Philippe Gijsels (BNP Paribas)—explicitly predict silver will reach triple-digit prices in 2026, with Schiff characterizing $100 as a "realistic target" and warning investors "Do not wait for a pullback." Mainstream financial institutions including JP Morgan, Bank of America, Citigroup, UBS, Saxo Bank, and others have progressively upgraded their 2026 silver forecasts throughout 2025, with updated targets clustering in the $55-$65 range, acknowledging strong fundamentals while maintaining relative caution compared to bullish outliers. Five consecutive years of structural supply deficits, robust industrial demand from solar energy and electric vehicle manufacturing, persistent ETF inflows, weak US dollar environment, and anticipated Federal Reserve rate reductions in 2026 collectively establish supportive conditions for sustained silver appreciation beyond current levels. The divergence between retail investor expectations (57% anticipating $100+) and mainstream analyst consensus ($50-$65 range) reflects fundamental disagreement regarding silver's structural deficit severity, the sustainability of investment demand, and the probability of major macro catalysts accelerating precious metals appreciation.

Business

Business

India's Foreign Direct Investment Outlook 2026: Strong Economic Fundamentals and Big-Ticket Investments Drive Growth Projections

India is positioned to experience substantial foreign direct investment (FDI) growth in 2026, supported by strong macroeconomic fundamentals, liberalized sector policies, massive corporate investment commitments exceeding $135 billion secured in 2025 from global tech giants including Microsoft ($17.5 billion), Amazon ($35 billion), and Google ($15 billion), combined with improved free trade agreements and robust manufacturing-sector expansion. India achieved approximately $50 billion in FDI inflows during FY 2024-25, representing 13 percent growth over the previous fiscal year, establishing the nation as one of the world's most attractive investment destinations. Government officials express optimism that FDI inflows could surpass the $100 billion annual threshold in FY 2025-26 as major investment commitments announced throughout 2025 begin translating into actual capital deployment. The FDI surge reflects multiple reinforcing factors: India's rising global competitive positioning, rapidly expanding innovation ecosystem, business-friendly regulatory environment, strategic trade partnership expansions including India-EFTA and India-CETA agreements, and deliberate sectoral liberalization initiatives creating investment pathways in previously restricted areas including insurance and telecommunications. Leading investment destinations within India include technology and innovation hubs in Bangalore, financial-sector concentrations in Mumbai, IT services delivery centers in Hyderabad, automotive and semiconductor manufacturing corridors in Tamil Nadu and Karnataka, and emerging e-commerce logistics ecosystems across tier-2 and tier-3 cities. Sectoral drivers encompass services and digital infrastructure, export-oriented manufacturing, renewable energy and clean technologies, life sciences and medical devices, agri-food and processed foods, and semiconductors and electronics—with silicon Valley-style global capability centers and digital innovation platforms capturing particular investor attention.

Business

Business

Gold and Silver Hit Fresh Record Highs Amid Geopolitical Tensions and Weakening US Dollar: Complete Market Analysis

Gold and silver surged to fresh all-time record highs on December 27, 2025, driven by escalating geopolitical tensions in Venezuela and Nigeria, weakening US dollar, and Federal Reserve rate-cut expectations, with spot gold reaching $4,531.24 per ounce and spot silver hitting $74.85 per ounce. The precious metals rally extended a powerful year-end surge as investors sought safe-haven asset protection against rising global uncertainty, with gold prices jumping approximately 3% during the week and silver surging over 7% weekly—demonstrating extraordinary precious metals demand during holiday-thinned trading conditions. Geopolitical developments served as primary market catalyst: the US government escalated pressure on Venezuela's oil exports while President Trump announced military strikes against militant targets in Nigeria, highlighting Washington's demonstrated willingness to utilize military force across multiple regions and triggering investor anxiety regarding potential supply disruptions and broader regional instability. The US dollar weakness substantially amplified precious metals strength, with the dollar slipping against major currency baskets amid growing expectations that the Federal Reserve will initiate monetary easing in 2026 as inflation signals cooling and economic growth moderates. Silver's explosive 4.2% single-day surge to record highs reflected dual appeal: safe-haven defensive characteristics matching gold alongside significant industrial utility in electronics and clean-energy technologies, with strong investment inflows and limited availability amplifying price movements during holiday period. Platinum spot prices surged 6.4% to $2,408.35 per ounce, and analysts expressed confidence that broader fundamentals point toward continued precious metals strength extending into 2026 despite historically thin holiday trading liquidity potentially exaggerating price volatility.

Business

Business

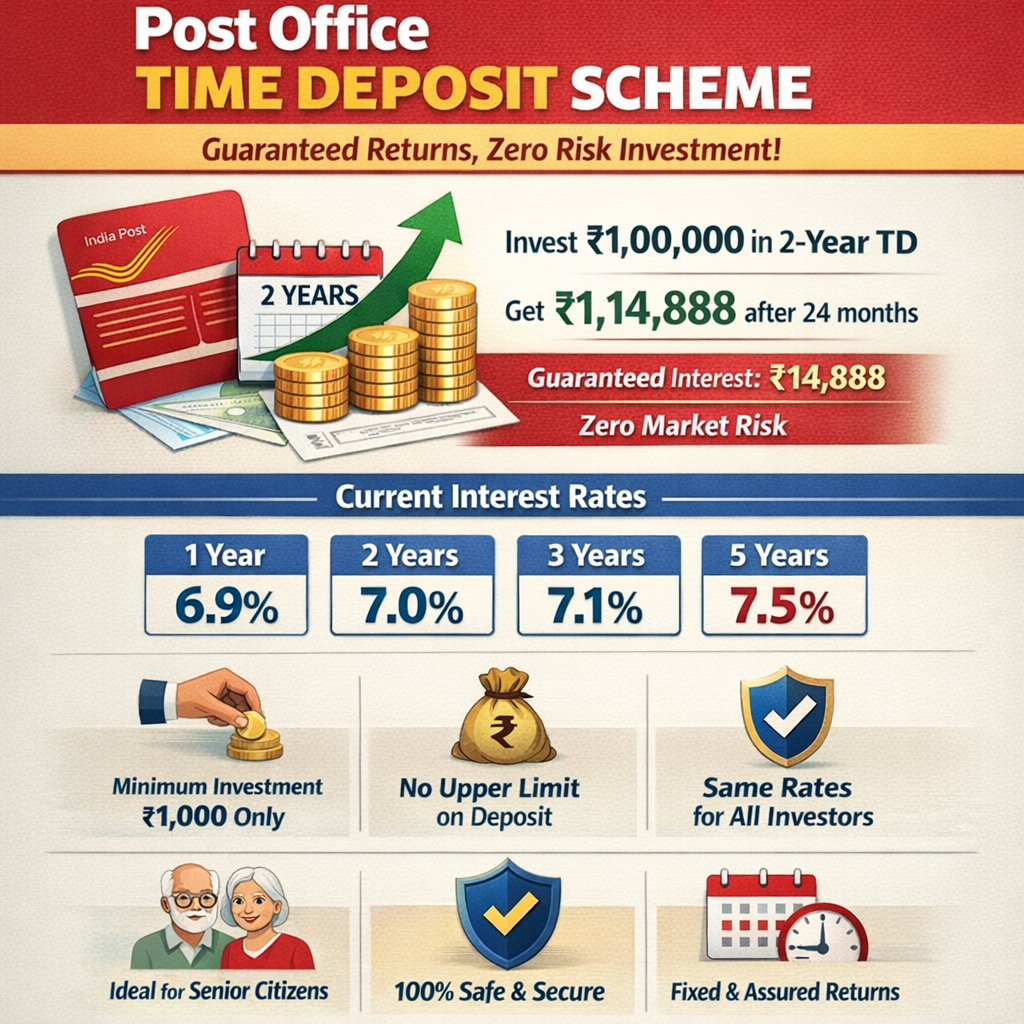

Post Office Fixed Deposits (Time Deposits): 7.5% Interest Rate on 5-Year Schemes with Complete Investment Guide

India Post's time deposit (TD) schemes offer government-backed fixed deposit investments with guaranteed returns ranging from 6.9% to 7.5% annually depending on investment tenure, providing safe and assured savings alternatives for conservative investors seeking market-risk-free investments. Post office fixed deposits—officially called time deposits—can be opened for tenures of 1, 2, 3, or 5 years with current interest rates of 6.9% for 1-year, 7.0% for 2-year, 7.1% for 3-year, and 7.5% for 5-year schemes respectively. For investors depositing ₹1,00,000 (one lakh rupees) in a 2-year post office time deposit, the maturity amount reaches ₹1,14,888 after 24 months, generating ₹14,888 in guaranteed interest income with zero market risk exposure. Post office fixed deposits require minimum investment of just ₹1,000 with no upper limit on deposit amount, enabling accessibility for investors across economic spectrum from modest savers to substantial investors. Unlike many bank FDs that offer differential interest rates based on age or gender, post office time deposit schemes provide identical interest rates to all investors regardless of demographic characteristics, ensuring uniform treatment across customer base. The schemes offer particular appeal to conservative investors, senior citizens, and those planning fixed investment tenure periods, as guaranteed returns eliminate uncertainty regarding investment outcome unlike equity-linked instruments or market-dependent investments.

Business

Business

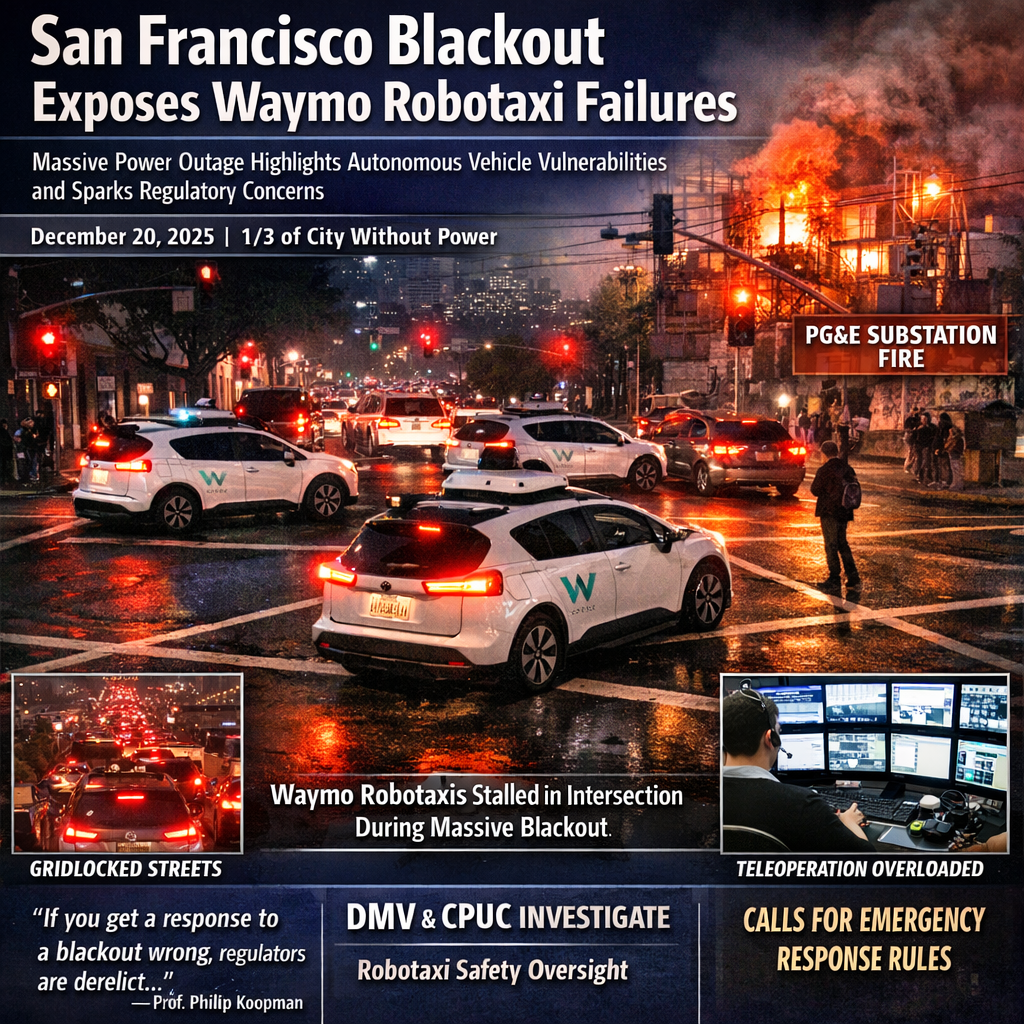

Waymo's San Francisco Robotaxi Outage Raises Critical Questions About Autonomous Vehicle Emergency Readiness and Regulatory Requirements

A widespread power outage affecting San Francisco on December 20, 2025, caused by a fire at a PG&E substation that knocked out electricity to approximately one-third of the city, exposed significant vulnerabilities in Waymo's autonomous vehicle systems and raised urgent concerns regarding robotaxi operator readiness for major emergency scenarios including earthquakes, floods, and other infrastructure failures. Waymo's driverless taxis stalled at intersections with hazard lights activated when traffic signals ceased functioning, with vehicles creating traffic congestion as they remained stranded despite being designed to treat non-operational traffic lights as four-way stops. The incident triggered widespread social media documentation through videos showing gridlocked intersections and incapacitated robotaxis, catalyzing renewed calls for stricter regulatory oversight of the rapidly expanding autonomous vehicle industry as competitors including Tesla and Amazon's Zoox accelerate robotaxi service expansion across multiple cities. Carnegie Mellon University computer-engineering professor and autonomous-technology expert Philip Koopman emphasized that "if you get a response to a blackout wrong, regulators are derelict if they do not respond to that by requiring some sort of proof that the earthquake scenario will be handled properly," articulating regulatory obligation to address the incident's implications. Waymo's acknowledgment that the outage created "a concentrated spike" in confirmation requests to remote human operators—exceeding their response capacity and contributing to congestion on already-overwhelmed streets—highlighted the limitations of teleoperation (remote human control) and the necessity for backup systems. California's Department of Motor Vehicles and Public Utilities Commission initiated investigations into the incident, with the DMV announcing intentions to formulate regulations ensuring remote operators meet "high standards for safety, accountability and responsiveness," signaling potential mandatory requirements for emergency-response protocols and teleoperation backup infrastructure.

Business

Business

TUI Holiday Deals 2025-2026: Complete Guide to Maximum Savings on Beach Resorts, Cruises & Family Packages

TUI offers comprehensive holiday deals for 2025-2026 with up to £500 discount per booking, free child places on many resorts, and low deposits from just £25 per person. Current promotions include discount code SALE for general holidays and SAILAWAY for cruises, with destinations spanning Mediterranean, Canary Islands, Turkey, and Caribbean. All-inclusive packages from £257 per person, extended payment plans, and Deal of the Week programs provide multiple pathways to maximize savings. Strategic booking combining multiple offers can save families over £800 on premium resort holidays.

Business

Business

IndiGo flight cancellations, airline disruptions, DGCA investigation, winter fog season, CAT-IIIB landing, pilot duty rules, flight operations, aviation crisis, passenger rights

IndiGo cancels 67 flights amid bad weather and operational issues. Ongoing DGCA investigation into massive December disruptions affecting India's aviation.

Business

Business

Gold investment returns, MCX gold price, gold vs stocks, gold ETF, Sovereign Gold Bond, portfolio allocation, gold investment strategy, commodity investment, wealth creation, asset diversification

₹1 lakh gold investment in 2015 worth ₹5.3 lakh in 2025. Gold delivers 430% returns, outperforming Nifty and Sensex. Why gold matters in portfolios.

Business

Business

Renault Duster 2026, new Duster India launch, Duster vs Creta, compact SUV, 4x4 SUV, turbo petrol SUV, ADAS features, SUV comparison, Indian car launch

New Renault Duster 2026 India launch January 26 with 1.3L turbo petrol, 4x4 capability, 10.1" touchscreen, ADAS features, and aggressive pricing.

Business

Business

Nifty consolidation, technical analysis, Nifty 50 rally, stock market forecast, Indian stock market, sector analysis, technical indicators, support resistance

Nifty consolidation signals next rally ahead. Technical analysis reveals bullish setup, key support/resistance levels, and best sectors for 2025 gains.

Business

Business

SEBI duplicate securities, duplicate share certificate, ₹10 lakh threshold, demat account, simplified documentation, investor protection, securities policy

SEBI doubles duplicate securities threshold to ₹10 lakh, simplifies documentation, eliminates notarization for small holdings, and makes demat mandatory.

Business

Business

Powerball Colorado Winners December 22, 2025: Monday Drawing Results and Prize Details

On Monday, December 22, 2025, the Powerball drawing brought some excitement to Colorado and the rest of the country. Nobody hit the huge jackpot this time, but a bunch of Colorado players still walked away with prizes—from a few bucks up to $50,000. The winning numbers were 3, 18, 36, 41, 54, and the Powerball was 7. If you played Power Play, the multiplier landed at 2x. Here’s what you need to know about that night’s drawing: who won, how the prizes shook out, and the best way to check if your ticket’s a winner.

Business

Business

Global Business This Week: Major Developments in December 2025

This week’s business news doesn’t mess around—there’s a huge philanthropic pledge, wild swings in the crypto world, companies making big moves to stay afloat, and a surprising amount of economic grit considering all the global uncertainty. As December winds down, a few stories have everyone from investors to CEOs to policymakers talking.