Opening Performance: Disappointing Collections and Immediate Decline

Day 1 Collection: ₹5.5 Crore Underwhelming Opening

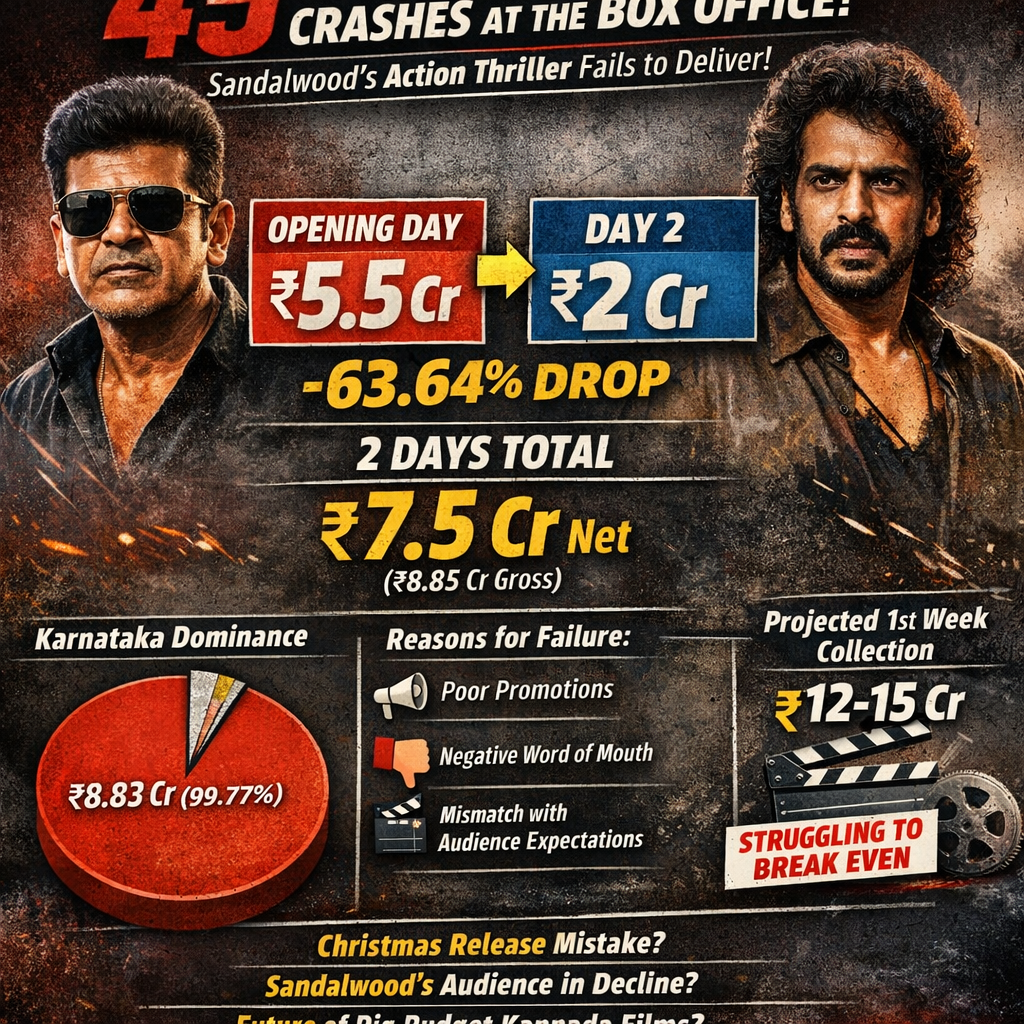

The 45 opening day net collection of ₹5.5 crore represents profoundly disappointing performance for film featuring Shivarajkumar—Kannada cinema's most prominent superstar with decades of box office drawing power and sustained commercial viability. Shivarajkumar's previous releases typically achieve opening days substantially exceeding ₹5.5 crore, with major films achieving ₹8-12 crore+ opening day collections depending on promotional effort and film positioning.

The opening day collection appears constrained by multiple factors: Christmas Day release timing creating multiplex availability constraints as established releases maintain dominant screen allocations; potential audience splitting amid concurrent theatrical releases (Chhaava, Avatar: Fire and Ash); and possible insufficient promotional impact preceding release date. Rather than single-factor explanation, the underwhelming opening suggests convergence of multiple unfavorable circumstances.

However, ₹5.5 crore opening day for Kannada language film on holiday release represents moderate performance within regional cinema context, though substantially below expectations for film featuring Shivarajkumar's star power and established box office appeal. The collection establishes baseline performance expectation for subsequent days.

Day 2 Collection: Catastrophic 63.64% Decline to ₹2 Crore

The precipitous decline from Day 1's ₹5.5 crore to Day 2's ₹2 crore—representing 63.64% decline—indicates catastrophic loss of audience momentum and severe negative word-of-mouth dissemination between opening and second day. Such dramatic decline far exceeds typical post-opening-day patterns where film maintain 70-90% of opening day collections on Day 2 for films with positive reception.

The magnitude of decline suggests multiple possibilities:

· Negative Audience Reception: Early preview audiences or opening day viewers experienced negative response to film's narrative, performances, or action sequences, immediately communicating disappointment through social networks and word-of-mouth

· Inadequate Promotional Messaging: Marketing may have misrepresented film positioning, creating audience expectations divergent from actual content

· Fundamental Film Quality Issues: The narrative, performances, or technical execution may have fallen significantly below audience expectations or industry quality standards

· Festival Holiday Competition: Christmas holiday activities (celebrations, family gatherings, alternative entertainment) may have deflated natural Day 2 theatrical attendance

A 63.64% decline—while not completely unprecedented—represents severe warning signal regarding film's overall commercial viability and fundamental audience reception issues.

|

Day |

Collection (Net) |

Change from Previous |

|

Day 1 |

₹5.5 Crore |

Opening Day |

|

Day 2 |

₹2 Crore |

-63.64% |

|

Total (2 Days) |

₹7.5 Crore |

Cumulative |

Shivrajkumar best movies

Shivarajkumar - IMDb

Shivarajkumar - IMDb

![]()

Geographic Distribution: Karnataka Dominance and Pan-India Failure

State-Wise Breakdown: Overwhelming Karnataka Concentration

The film's geographic distribution reveals pronounced regional concentration with ₹8.83 crore gross collection sourcing entirely from Karnataka, representing 99.77% of total theatrical revenue, while remaining Indian markets contributed negligible returns:

|

Region |

Day 1 |

Day 2 |

Total Gross |

Percentage |

|

Karnataka |

₹6.49 Cr |

₹2.34 Cr |

₹8.83 Cr |

99.77% |

|

Andhra Pradesh/Telangana |

₹0 |

₹0 |

₹0 |

0% |

|

Tamil Nadu |

₹0.01 Cr |

₹0.01 Cr |

₹0.02 Cr |

0.23% |

|

Kerala |

₹0 |

₹0 |

₹0 |

0% |

|

Rest of India |

₹0 |

₹0 |

₹0 |

0% |

|

Total |

₹6.5 Cr |

₹2.35 Cr |

₹8.85 Cr |

100% |

The absolute geographic dominance of Karnataka—comprising 99.77% of theatrical revenue while remaining Indian regions collectively contribute 0.23%—indicates the film achieved zero meaningful distribution outside native Kannada-speaking regions. This regional-only performance reflects Sandalwood cinema's typical geographic limitations while simultaneously indicating insufficient marketing effort or audience appeal for pan-India theatrical footprint.

Negligible Performance in Secondary Markets

Tamil Nadu's marginal contribution (₹0.02 crore across two days—less than 0.25% of total)—despite logical geographic proximity to Karnataka and established Tamil cinema audience infrastructure—suggests either non-existent theatrical distribution in Tamil Nadu or complete audience indifference toward Kannada film. The negligible performance indicates the film made no meaningful attempt toward South Indian regional expansion.

The complete absence of collections from Andhra Pradesh/Telangana, Kerala, and Rest of India confirms the film operated exclusively as Karnataka regional release rather than pursuing broader South Indian distribution or metropolitan Hindi-region reach. This singular geographic focus limits total revenue potential and establishes ceiling on ultimate lifetime collection capacity.

Overseas Collection: Conspicuously Absent

Conspicuously absent from collection data: overseas collections reportedly ₹0 crore, indicating either zero theatrical distribution internationally or negligible diaspora interest in Kannada cinema releases. The complete overseas absence—despite Kannada diaspora populations in Gulf countries, North America, and Europe—suggests either deliberate international distribution strategy non-prioritization or extraordinary lack of overseas audience interest.

List of highest grossing Kannada films of 2025

![]()

Film Details: Cast, Crew, and Production Information

Lead Cast: Shivarajkumar and Upendra's Star Power Insufficient

The film stars Kannada cinema's two most prominent and commercially viable stars—Shivarajkumar and Upendra—alongside character actors Raj B. Shetty, Rajendran, and actress Pooja Ramachandra, establishing star-studded ensemble positioning.

Shivarajkumar, Kannada superstar with four-decade career and consistent box office track record, brings established commercial viability and audience recognition spanning multiple demographic segments. However, his presence failed to generate expected opening day momentum, suggesting either inadequate promotional emphasis on his stardom or fundamental disconnect between his star power and film's thematic content.

Upendra, Kannada cinema's most artistically ambitious and unconventional actor-director known for provocative, experimental films like Upendra (1999) and his controversial political activism, brings artistic credibility alongside star recognition. His inclusion suggests the film aspired toward artistic legitimacy beyond purely commercial entertainment.

Raj B. Shetty, critically acclaimed character actor known for refined performances and nuanced character work, elevates supporting cast quality through professional acting standards.**

Production and Direction: Professional Infrastructure

The film is produced by Suraj Productions and directed by Arjun Janya, establishing professional production infrastructure and directing credibility. However, neither production company nor directorial reputation appears sufficient to overcome opening day momentum challenges and negative word-of-mouth dissemination affecting Day 2 collections.

Raj B. Shetty - IMDb

Raj B. Shetty - IMDb

Real Star Upendra on Why his Movie A Was Blockbuster

![]()

Performance Analysis: Understanding the Underperformance

Multiple Contributing Factors to Commercial Failure

The profound underperformance—evidenced by catastrophic Day 2 decline and geographic limitation to Karnataka—suggests multiple converging factors rather than single-cause explanation:

1. Christmas Day Release Disadvantages: Thursday Christmas release created multiplex allocation constraints; established releases maintained dominant screen positions, constraining new release access. Additionally, holiday entertainment alternatives (family activities, streaming platforms, festive celebrations) competed directly with theatrical exhibition.

2. Insufficient Promotional Impact: The lack of pre-release promotional momentum visible in opening day collection suggests either minimal marketing investment preceding release or ineffective promotional messaging failing to generate audience interest.

3. Negative Word-of-Mouth: The 63.64% Day 2 decline—far exceeding typical post-opening patterns—indicates early audiences communicated significant disappointment through social networks and informal recommendation channels.

4. Potential Genre-Audience Mismatch: Action drama thriller genre may have attracted insufficient Sandalwood audience; the film may have positioned itself ambiguously regarding target demographic expectations.

5. Star Power Decay: Even Shivarajkumar's substantial star power failed to generate expected opening momentum, suggesting either audience appetite decline for Kannada cinema theatrical releases or specific perception that the film failed to justify investment.

Comparison to Shivarajkumar Baseline Expectations

Shivarajkumar's filmography establishes opening day baseline expectations of ₹8-12 crore+ for major releases, making ₹5.5 crore opening represent 35-45% decline from reasonable expectations based on his star power. This magnitude of underperformance relative to established star baseline indicates film-specific problems rather than broader industry challenges.

![]()

Financial Viability Assessment: Projected Lifetime Collection Implications

Budget Estimation and Collection Sufficiency

*While official production budget remains undisclosed (noted as "₹ - Cr Approx" in box office data), films featuring Shivarajkumar and Upendra typically require ₹40-60 crore production budgets for comprehensive technical execution, star compensation, and marketing investment. The ₹7.5 crore two-day collection represents only 12-19% of conservative estimated budget.

Realistic Lifetime Collection Projections

Based on opening week trajectory and competitive theatrical landscape, realistic lifetime collection projections estimate ₹12-18 crore total—insufficient to approach cost recovery relative to estimated ₹40-60 crore production budget. Even optimistic scenarios projecting weekend multiplier of 2.0x-2.5x opening day suggest cumulative opening weekend total of ₹11-13.75 crore, with weekday performance unlikely to generate sufficient additional revenue for cost recovery.

Such lifetime collection range would classify the film as outright "disaster" by industry terminology, representing severe financial loss and return-on-investment failure for producers and investors.

For production company Suraj Productions and associated investors, a ₹12-18 crore lifetime collection against likely ₹40-60 crore investment represents catastrophic financial outcome requiring serious loss management and investor compensation negotiations. The experience may influence future filmmaking decisions, promotional strategies, and release timing considerations.

![]()

Sandalwood Industry Context: Broader Market Implications

Kannada Cinema's Theatrical Viability Questions

45's disappointing performance raises broader questions regarding Sandalwood cinema's theatrical viability during contemporary market conditions characterized by streaming competition, audience fragmentation, and shifting exhibition patterns. Even films featuring commercially viable stars and professional production infrastructure fail to generate expected theatrical momentum.

Regional Cinema Challenges and Opportunities

The complete geographic limitation to Karnataka—absent meaningful distribution in South Indian markets or pan-India reach—reflects Sandalwood cinema's typical geographic constraints while simultaneously indicating limited inter-regional appeal or cross-regional audience development. This limitation fundamentally restricts total revenue potential and theatrical window viability.

Holiday Season Release Strategy Questions

The Christmas Day release decision—creating multiplex availability constraints and competing with established releases maintaining dominant positions—may represent strategic error impacting opening day momentum. Future major releases may require stronger pre-release positioning and release timing optimization to overcome holiday period challenges.

![]()

Conclusion: 45's Disappointing Opening and Uncertain Theatrical Future

45's opening day collection of ₹5.5 crore and catastrophic 63.64% Day 2 decline to ₹2 crore represents profound underperformance for action drama thriller featuring Kannada cinema's two most prominent stars, Shivarajkumar and Upendra. The two-day cumulative collection of ₹7.5 crore net, completely concentrated in Karnataka market (99.77% of revenue), indicates fundamental commercial failure and severe audience resistance.

The dramatic Day 2 decline—substantially exceeding typical post-opening patterns—signals negative word-of-mouth dissemination and potential film quality issues, audience reception disappointment, or fundamental disconnect between film positioning and audience expectations. The magnitude of decline suggests problems transcending merely release timing or promotional insufficiency.

Geographically, the film's complete limitation to Karnataka and absolute failure to achieve meaningful pan-India distribution establishes realistic ceiling on ultimate lifetime collection capacity, with projections estimating ₹12-18 crore total—insufficient for cost recovery against estimated ₹40-60 crore production budget. The financial failure represents significant loss for producers and investors.

For Sandalwood cinema broadly, 45's disappointing performance contributes to concerning pattern of regional cinema theatrical viability challenges, audience fragmentation, and shifting market dynamics disadvantaging traditional regional cinema releases. Whether theatrical exhibition remains viable for Kannada productions, even featuring established star power, remains increasingly uncertain.

As extended weekend performance and first-week trajectory unfold, 45's ultimate box office determination and franchise viability will likely influence future Sandalwood production decisions, star availability, and investment patterns for subsequent regional cinema releases. The film's failure may catalyze significant industry recalibration toward proven concepts, established commercial formulas, and strategic release timing optimization.**

![]()

Citations:

Sacnilk - 45 Box Office Collection | All Language | Day Wise | Worldwide (2025); Kannada cinema box office analysts - Regional film performance analysis and commercial trends; IMDb - 45 (2025) Kannada film details and cast information; Shivarajkumar filmography - Career overview and opening day collection comparisons; Upendra filmography - Career documentation and commercial track record; Suraj Productions - Production company information and film backing details; Kannada cinema industry publications - Sandalwood market dynamics and theatrical viability assessment; Box office tracking data - Opening day performance analysis and financial projections; Release timing analysis - Christmas Day release strategic implications for theatrical performance

Post your opinion

No comments yet.