Post Office Time Deposits: Understanding Government-Backed Fixed Investment Schemes

What Are Post Office Time Deposits (TDs)?

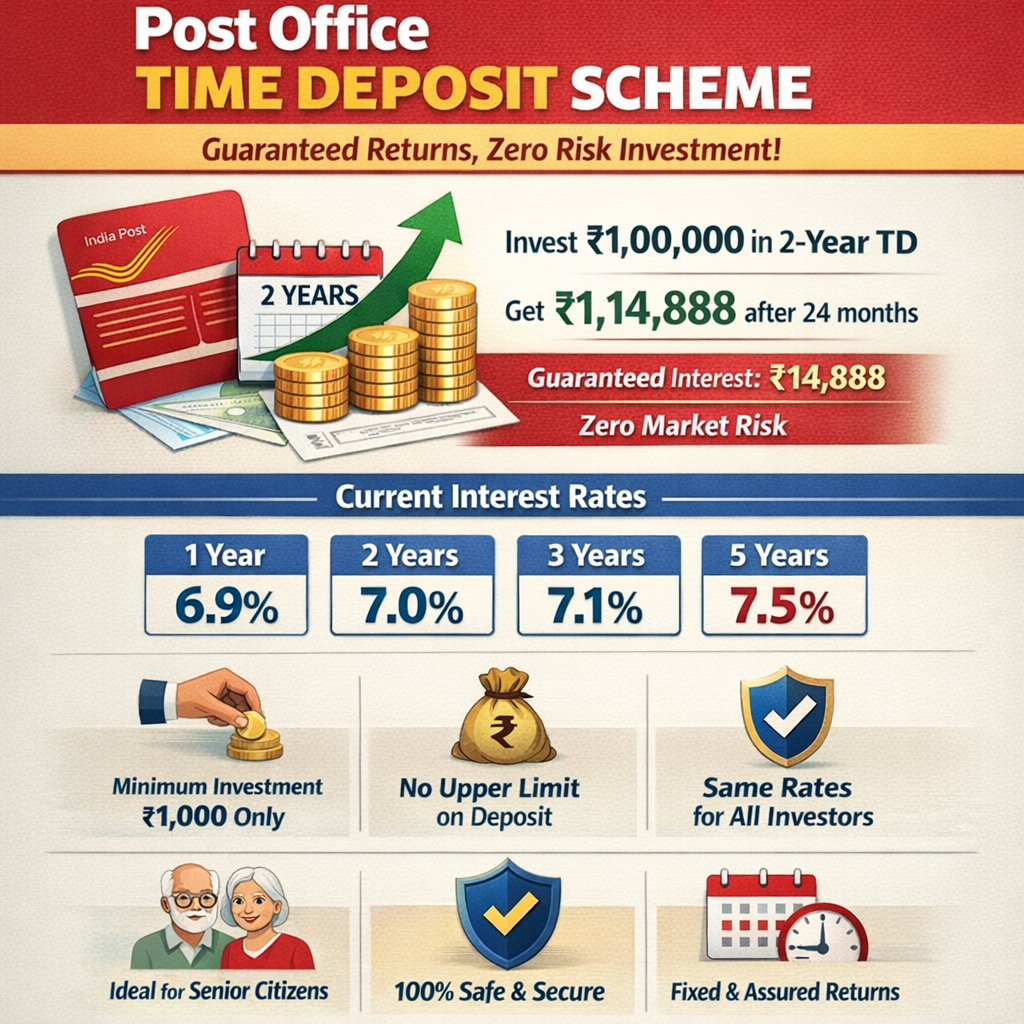

Post office time deposits, commonly referred to as post office fixed deposits (FDs), represent government-backed investment instruments enabling individuals to deposit specified amounts for fixed durations with guaranteed return of principal plus accumulated interest at maturity. The schemes operate under India Post's small savings framework, providing constitutional protection through government backing and institutional stability.

Unlike bank fixed deposits that may vary by institution and product variation, post office time deposits operate uniformly across all Indian postal branches, ensuring consistent product definition and interest rate standardization nationwide. This uniformity provides simplicity and transparency—investors understand exactly what returns will be received regardless of which post office branch they approach.

Time deposits function similarly to bank certificates of deposit (CDs), where investors commit funds for specified periods in exchange for fixed interest rates applicable for the full deposit duration. The predetermined interest rate—established at deposit creation—remains unchanged throughout the maturity period, providing certainty regarding final return amount.

Investment Tenure Options and Flexibility

Post office time deposits offer four tenure options enabling investors to match investment duration to financial planning timelines:

1-Year Time Deposits: 6.9% Annual Interest Rate

· Shortest tenure option for investors requiring capital availability within annual timeframe

· Suitable for short-term capital deployment and flexibility-prioritizing investors

2-Year Time Deposits: 7.0% Annual Interest Rate

· Mid-range option balancing reasonable tenure commitment with moderate interest improvement

· Common choice for investors planning moderate medium-term capital needs

3-Year Time Deposits: 7.1% Annual Interest Rate

· Extended tenure option providing slightly enhanced interest rate compensation

· Appropriate for investors comfortable with 3-year capital commitment

5-Year Time Deposits: 7.5% Annual Interest Rate

· Maximum tenure option offering highest interest rate reward

· Best for long-term investors prioritizing maximum assured returns

The tenure progression—offering incrementally higher interest rates for extended commitment periods—reflects standard fixed-deposit industry practice: longer commitment enables borrower (Post Office/government) to secure funds longer-term, justifying enhanced interest compensation.

Minimum and Maximum Investment Limits

Post office time deposits require minimum initial investment of just ₹1,000 (one thousand rupees), establishing accessibility for modest investors beginning their savings journey. The low minimum barrier enables even individuals with limited capital to access government-backed guaranteed returns.

There exists no maximum investment limit on post office time deposits, enabling substantial investors to deploy entire savings through single or multiple TD accounts. The unlimited upper threshold accommodates investors from all wealth levels, from modest savers to substantial investors managing substantial investable surplus.

This accessibility structure—combining low minimum entry with unlimited maximum capacity—positions post office time deposits as universally accessible savings vehicle regardless of investor financial status.

India Post goes high-tech, geo-tags post offices on Bhuvan ...

Revolutionizing Mail Services: India's First 3D Printed Post ...

![]()

Interest Rates and Return Calculations: How Investment Grows

Current Post Office Time Deposit Interest Rates (December 2025)

The current post office time deposit interest rates reflect quarterly review and adjustment process determining government small savings returns:

|

Tenure |

Interest Rate |

Compounding Frequency |

|

1 Year |

6.9% p.a. |

Annually |

|

2 Years |

7.0% p.a. |

Annually |

|

3 Years |

7.1% p.a. |

Annually |

|

5 Years |

7.5% p.a. |

Annually |

These rates represent competitive positioning relative to bank fixed deposit offerings, often matching or exceeding typical bank FD rates depending on bank and deposit type. The government-backed interest rates provide stability and guarantee absent from some private sector financial instruments.

Calculating Returns: ₹1 Lakh Investment Example

For investor considering ₹1,00,000 (one lakh rupees) investment in a 2-year post office time deposit, the return calculation demonstrates the guaranteed return mechanism:**

Investment Details:

· Principal Amount: ₹1,00,000

· Investment Duration: 2 Years (24 months)

· Interest Rate: 7.0% per annum

· Compounding: Annual

Return Calculation:

Using the compound interest formula: A = P(1 + r/100)^t

Where:

· A = Final maturity amount

· P = Principal (₹1,00,000)

· r = Annual interest rate (7.0%)

· t = Time period in years (2)

A = 1,00,000 × (1 + 7.0/100)²

A = 1,00,000 × (1.07)²

A = 1,00,000 × 1.1449

A = ₹1,14,490 (approximately)

Actual Post Office Calculation Result: ₹1,14,888**

Interest Earned: ₹14,888 (₹1,14,888 maturity amount minus ₹1,00,000 principal)

The calculation demonstrates that investing ₹1 lakh for 2 years generates guaranteed interest income of ₹14,888, resulting in maturity amount of ₹1,14,888. This guaranteed return—approximately 14.9% total return over 2-year period—provides predictable wealth accumulation for conservative investors.

Extended Example: 5-Year High-Interest Option

For investor considering maximum 5-year tenure with highest interest rate, the returns demonstrate significant wealth growth potential:

5-Year Investment Calculation:

· Principal: ₹1,00,000

· Interest Rate: 7.5% annually

· Duration: 5 years

Using compound interest calculation:

A = 1,00,000 × (1.075)⁵

A = 1,00,000 × 1.4356

A = ₹1,43,560 (approximately)

Total Interest Earned: ₹43,560 (approximately)

The 5-year investment generates ₹43,560 in guaranteed interest—significantly higher than 2-year scheme—demonstrating how extended investment tenure generates progressively higher absolute returns. The compound interest effect becomes increasingly pronounced over longer periods.

Compound Interest Calculator – Grow Your Investments Faster

Compound Interest Calculator | Acorns

![]()

Advantages of Post Office Fixed Deposits: Why Investors Choose TDs

Government Backing and Institutional Safety

Post office time deposits benefit from explicit government of India backing, establishing constitutional guarantee of principal protection and interest payment regardless of economic circumstances or institutional challenges. The government backing—distinct from private bank deposits backed only by deposit insurance corporation coverage—provides maximum institutional safety.

India Post operates as established government institution with century-spanning operational history, providing continuity assurance and administrative stability absent in newer financial institutions. The institutional longevity and government ownership inspire investor confidence regarding long-term viability.

Guaranteed Returns Without Market Risk

Post office time deposits eliminate market risk entirely: the interest rate and maturity amount are predetermined at deposit inception, independent of market fluctuations, equity price movements, inflation trends, or economic cycles. The guaranteed returns provide certainty transcending market-dependent instruments.

Unlike equity mutual funds, stock investments, or commodity holdings—where returns depend on unpredictable market performance—post office TDs deliver predetermined returns regardless of market conditions. This guaranteed structure provides psychological comfort and financial planning certainty unavailable through market-dependent investments.

Fixed Interest Rates: No Demographic Discrimination

Unlike many bank fixed deposits offering different interest rates based on age (higher rates for senior citizens), gender, or customer category, post office time deposits provide uniform interest rates to all investors. The unified rate structure ensures equitable treatment regardless of demographic characteristics.

A 25-year-old investor and a 70-year-old investor receive identical interest rates on post office TDs, contrasting with bank FDs often offering senior citizen premiums. This democratic rate structure eliminates the need for age verification and enables straightforward investment decisions.

Low Entry Barriers and Accessibility

The ₹1,000 minimum investment requirement establishes minimal entry barrier, enabling even modest-income individuals to commence systematic savings through post office TDs. The low minimum accessibility distinguishes post office schemes from some premium investment products requiring substantial minimum investments.

The unlimited upper investment limit accommodates investors across entire economic spectrum, from individuals with modest savings capacity to high-net-worth individuals deploying substantial capital. This accessibility structure makes post office TDs universally available investment vehicle.

Flexibility in Account Ownership

Post office time deposits can be opened in investor's own name or in the name of family members—spouse, children, or other dependents—enabling strategic family financial planning and wealth distribution. The account ownership flexibility enables investors to optimize family wealth structure and succession planning.

Opening deposits in spouse's name, for example, enables income distribution strategy for taxation purposes, as the spouse's interest income is taxed in their tax bracket rather than yours. This flexibility provides tax-planning opportunities within India's progressive taxation framework.

Certificate of deposit hi-res stock photography and images ...

Senior Citizen Savings Scheme (SCSS) 2025: Interest Rate ...

![]()

Comparison: Post Office TDs vs. Bank Fixed Deposits

Post office time deposits currently offer 7.0% (2-year) and 7.5% (5-year) rates, comparing favorably to many bank fixed deposit offerings which frequently range from 6.5% to 7.5% depending on bank, deposit amount, and customer category. The post office rates remain competitive within financial market landscape.

Major banks such as HDFC Bank, ICICI Bank, and State Bank of India offer FD rates in similar range, with some offering premium rates for senior citizens or substantial deposits exceeding ₹2 crore. The post office competitiveness eliminates disadvantage relative to banking sector.

While bank deposits receive protection through Deposit Insurance and Credit Guarantee Corporation (DICGC) coverage limited to ₹5 lakh per bank per account, post office TDs benefit from direct government backing without insurance coverage limits. The government guarantee provides superior protection ceiling.

The post office government backing—providing constitutionally guaranteed repayment—exceeds insurance-based protection mechanisms, offering theoretical unlimited protection regardless of deposit amount. This safety advantage particularly benefits investors with substantial deposits.

Rate Predictability and Administration

Post office interest rates adjust quarterly based on government review of small savings rates, while bank FD rates change at bank discretion without prescribed review schedule. The post office framework provides more predictable rate update schedule, though neither guarantees rate stability.

Post office administration operates through nationwide branch network with standardized procedures, while banking administration involves bank-specific procedures and requirements varying across institutions. Post office uniformity simplifies investor experience but reduces product customization options available through banks.

Investing In Mutual Funds V/S Fixed Deposits. Which is Best?

Post Office Small Savings Scheme Interest Rate July ...

![]()

Eligibility and Account Opening: Who Can Invest?

Investor Eligibility: Universal Accessibility

Post office time deposits remain available to any resident Indian individual regardless of age, occupation, income level, or prior banking history. The universal eligibility eliminates barriers that might restrict access through other financial institutions.

Non-resident Indian (NRI) investors face restrictions on opening post office TDs—post office schemes generally target resident populations only. NRIs must explore alternative investment vehicles through banking channels or designated NRI investment schemes.

Minors can have post office TDs opened in their name with parental or guardianship consent, enabling parents and guardians to build children's savings through government-backed schemes. The minor account option provides tax-efficient wealth accumulation for children's future needs.

Post office time deposits can be opened at any India Post branch maintaining savings accounts and investment services. The widespread branch network—with over 1.5 lakh post offices across India—provides convenient accessibility for investment account opening.

Opening requirements typically include:

· Identity proof (Aadhaar, PAN, Passport, or other government ID)

· Address proof (utility bills, official correspondence, or other documentary evidence)

· Initial deposit amount (minimum ₹1,000)

· Completed TD account opening form

The documentation requirements remain relatively straightforward compared to some banking products, enabling quick account opening without extensive verification procedures. The simple process facilitates rapid investment commencement.

![]()

Tax Implications and Investment Strategy

Post office time deposit interest income qualifies as taxable income under Indian income tax provisions, subject to progressive income tax rates applicable to the individual investor. The interest earned is not tax-exempt despite government backing.

Interest income below ₹40,000 annually (or ₹50,000 for senior citizens) may avoid TDS (Tax Deducted at Source) if investor submits appropriate declarations, though ultimate taxation liability depends on individual total income. The TDS exemption mechanism enables tax-efficient investing for modest-income investors.

Investors in higher tax brackets should consider tax implications of post office TD interest income relative to tax-saving investment alternatives such as Public Provident Fund (PPF) or tax-deductible senior citizen savings schemes. Tax planning can optimize overall after-tax returns.

Post office time deposits serve optimal purposes for:

· Conservative investors seeking guaranteed returns without market risk

· Retirees requiring predictable income from investments

· Emergency fund building with assured accessibility

· Short-medium-term goals with defined timeline and required corpus

· Diversification allocation within broader investment portfolio

· Family wealth distribution through accounts in multiple family members' names

The schemes function effectively as building blocks within diversified investment strategy, particularly for investors prioritizing capital preservation over maximum growth potential.

![]()

Conclusion: Post Office Time Deposits as Conservative Investment Solution

Post office time deposits—offering 6.9% to 7.5% guaranteed interest rates across 1-5 year tenures—represent government-backed, risk-free investment vehicle ideal for conservative investors prioritizing capital preservation and assured returns. The schemes provide particular value for retirees, modest-income savers, and investors uncomfortable with market-dependent investment vehicles.

For investors depositing ₹1,00,000 in 2-year post office time deposits, the guaranteed maturity amount of ₹1,14,888—generating ₹14,888 interest income—demonstrates predictable wealth accumulation without market uncertainty. The calculation illustrates how modest investment generates meaningful returns over multi-year periods.

The universal accessibility—combining ₹1,000 minimum entry barrier with unlimited upper investment limit, identical interest rates across demographic groups, and widespread post office branch availability—positions post office TDs as universally accessible savings mechanism. The democratized structure enables participation across entire economic spectrum.

As investors navigate 2026 financial planning and seek appropriate allocation for conservative portfolio portions, post office time deposits merit serious consideration for their combination of safety, accessibility, competitive returns, and government backing. The schemes deliver on the fundamental promise of fixed income investing: guaranteed returns without complexity or risk.**

![]()

Citations:

News18 - Post Office FD Offers 7.5% Interest: See How Much Rs 1 Lakh Grows In 2 Years (2025); India Post official website - Time deposit interest rates and scheme details (December 2025); India Post - Post Office Savings Scheme documentation; Ministry of Communications, India Post Department - Government small savings schemes framework; Financial calculator analysis - Compound interest calculations for investment returns; Reserve Bank of India - Interest rate policy and small savings framework; Deposit Insurance and Credit Guarantee Corporation - Bank deposit insurance coverage limits; Bank FD comparison analysis - Major bank fixed deposit rate structures; Income tax department - Interest income taxation provisions and TDS thresholds; Investment advisory content - Conservative investment strategy and portfolio allocation recommendations

Post your opinion

No comments yet.