Gold Investment Returns 2015 to 2025: How ₹1 Lakh Grew to ₹5.3 Lakh in India

Gold has delivered an exceptional 430.99% return over the past decade, transforming a ₹1 lakh investment made in December 2015 into a stunning ₹5.3 lakh by December 2025, dramatically outperforming traditional stock market indices. This remarkable performance validates gold's role as a critical diversification asset in balanced investment portfolios and demonstrates why expert financial planners recommend 10-15% allocation to precious metals. As global economic uncertainty, inflation concerns, and central bank accumulation continue to support bullion prices, understanding gold's investment dynamics and comparing it with equity returns becomes essential for building wealth effectively.

Gold Bar Gold Coin Money Investing Stock Photo 2461662727 ...

The Gold Investment Journey: From ₹1 Lakh to ₹5.3 Lakh

The Starting Point: December 2015

On December 24, 2015, gold on the Multi Commodity Exchange (MCX) was trading at ₹25,148 per 10 grams, marking the beginning of a remarkable wealth creation journey for disciplined investors. An investor who allocated ₹1 lakh to gold at this price point would have purchased approximately 39.8 grams of the precious metal—a modest quantity that would ultimately transform into a substantial asset over the next decade.[1]

At this time, gold was widely perceived as a slow-moving commodity in investment circles, with many portfolio managers and retail investors favoring equities for their historically superior long-term returns. The narrative around gold suggested it was primarily suitable for jewelry purchases and safe-haven storage rather than serious wealth accumulation. This mindset would prove to be a significant oversight for those who underestimated gold's potential.

Fast forward exactly one decade to December 24, 2025, and the transformation is spectacular. The MCX spot price of gold had soared to ₹1,36,153 per 10 grams, making that initial 39.8-gram holding worth an impressive ₹5,30,996—over five times the original investment amount.[1]

This represents a 430.99% appreciation in nominal terms, translating to approximately a five-fold multiplication of capital in just ten years. For context, this means that every rupee invested in gold in December 2015 had grown to approximately ₹5.31 by December 2025. The magnitude of these returns challenges the long-standing perception that gold is a "wealth preservation" asset rather than a "wealth creation" instrument.

Breaking Down the Math: Calculating Returns

Investment Parameters:

· Initial Investment: ₹1,00,000

· Gold Price (Dec 24, 2015): ₹25,148/10 grams

· Quantity Purchased: 39.8 grams (approximately)

· Current Price (Dec 24, 2025): ₹1,36,153/10 grams

· Current Value: ₹5,30,996

· Absolute Gain: ₹4,30,996

· Percentage Return: 430.99%

Annualized Breakdown:

· Average Annual Return: Approximately 18-20% (depending on calculation method)

· Compounded Annual Growth Rate (CAGR): Approximately 18.5%

This CAGR of 18.5% significantly exceeds typical fixed-deposit returns (6-7%), debt mutual fund returns (7-9%), and even rivals or exceeds equity returns for many investors.[2][1]

Exclusive Financial Data on a Stock Market Chart Showing an ...

Gold vs. Equity Markets: The 10-Year Performance Showdown

The past decade has witnessed an extraordinary reversal of the traditional narrative that equities always outperform commodities. Let's examine how gold stacks up against India's premier stock indices:

Nifty 50 Performance (2015 vs 2025):[2]

· Nifty 50 Level in 2015: ~7,800

· Nifty 50 Level in 2025: ~24,500

· 10-Year Return: Approximately 215%

· Annual Average Return: 21.5%

BSE Sensex Performance (2015 vs 2025):[2]

· Sensex Level in September 2015: ~25,700

· Sensex Level in December 2025: ~80,000

· 10-Year Return: Approximately 210%

· Annual Average Return: 21.0%

Gold Performance (2015 vs 2025):[2]

· Gold Price in 2015: ₹25,000/10 grams

· Gold Price in 2025: ₹1,05,000+/10 grams

· 10-Year Return: Approximately 320% (mid-year) to 430% (year-end)

· Annual Average Return: 18.5-20%

The Surprise: Gold Outperforms Equities

Contrary to conventional wisdom, gold has actually outperformed both the Nifty 50 and Sensex over the past decade. With 320-430% returns, gold has surpassed the Sensex's 210% and Nifty's 215% returns—a remarkable achievement for an asset class traditionally considered a passive hedge.[2][3]

This outperformance is particularly striking because it occurred during a period when:

· The Indian economy was considered one of the world's fastest-growing major economies

· Stock markets reached multiple all-time highs

· Corporate earnings expanded substantially

· The Sensex and Nifty delivered respectable double-digit annual returns

Yet gold still managed to deliver superior absolute returns, fundamentally challenging the traditional equity-first investment philosophy.

Why Did Gold Outperform? Key Drivers

Global Economic Uncertainty:[4]

The 2015-2025 period was characterized by significant global economic turbulence—Brexit, US-China trade tensions, COVID-19 pandemic, and geopolitical conflicts. During such uncertainty, investors globally seek safe-haven assets, driving gold demand and prices higher.

Persistent inflationary pressures in the global economy, particularly following pandemic-era monetary expansion, made gold increasingly attractive as an inflation hedge. Gold's intrinsic value helps preserve purchasing power when currencies weaken.

Central Bank Accumulation:[1]

Central banks worldwide, including India's Reserve Bank, have been accumulating gold reserves. This institutional demand provides structural support to prices and represents a significant fundamental driver beyond speculative trading.

Weakness in the Indian Rupee against the US Dollar during various periods made gold more attractive to Indian investors, as gold is internationally traded in dollars.

Low Interest Rate Environment:[3][4]

Periods of low or negative real interest rates (when inflation exceeds bond yields) enhance gold's appeal relative to traditional fixed-income instruments that provide minimal returns.

ETF Inflows and Institutional Demand:[9][1]

Increasing investor adoption of gold ETFs and mutual funds as convenient investment vehicles drove consistent demand, supporting price appreciation.

Gold vs Nifty 50: Which Investment is Better in 2025 ...

Historical Gold Price Analysis: Tracking the Decade

Gold prices have shown a consistent uptrend with temporary corrections:[10][11]

|

Year |

Gold Price (₹/10gm) |

Change from Previous Year |

Cumulative Change from 2015 |

|

2015 |

₹24,931 |

— |

0% (Baseline) |

|

2016 |

₹27,445 |

+10.1% |

+10.1% |

|

2017 |

₹29,156 |

+6.2% |

+16.9% |

|

2018 |

₹31,391 |

+7.7% |

+25.8% |

|

2019 |

₹39,108 |

+24.6% |

+56.8% |

|

2020 |

₹50,151 |

+28.2% |

+100.9% |

|

2021 |

₹48,099 |

-4.1% |

+92.8% |

|

2022 |

₹55,017 |

+14.4% |

+120.5% |

|

2023 |

₹63,203 |

+14.9% |

+153.3% |

|

2024 |

₹78,245 |

+23.8% |

+213.5% |

|

2025 (YTD) |

₹1,36,570 |

+74.3% |

+447% |

2019-2020: The Acceleration Phase

The most dramatic price surge occurred between 2019-2020, with gold appreciating 52.8% in just two years. This period coincided with:[6]

· The onset of the COVID-19 pandemic and economic lockdowns

· Central bank rate cuts and quantitative easing globally

· Flight to safety as investors sought stable assets

· Significant currency depreciation in emerging markets

2024-2025: The Current Rally

The current rally is even more impressive, with gold delivering more than 35% returns in just nine months of 2025 and 98% returns over the past two years (2024-2025). This recent surge reflects:[3]

· Persistent geopolitical tensions and global conflicts

· Inflation concerns continuing despite rate hikes

· Expectations of monetary easing by central banks

· Increased international gold prices in dollar terms

The Importance of Gold in a Diversified Investment Portfolio ...

Gold vs. Silver: The Broader Precious Metals Story

Silver's Comparable Performance

While gold has dominated headlines, silver has also delivered impressive returns, making a strong case for precious metals allocation in portfolios:

Silver Price Movement (2015-2025):[2]

· Silver Price in 2015: ₹33,300/kg (approximately)

· Silver Price in 2025: ₹1,23,000/kg (approximately)

· 10-Year Return: Approximately 270%

· Annual Average Return: Approximately 13.4%

Although silver's 270% return trails gold's 430%+ return, it still surpasses both the Nifty (215%) and Sensex (210%) returns, proving that precious metals as a category have been stellar performers during this decade.

Silver's Volatility Advantage:

Silver exhibits greater price volatility than gold, which can be viewed as:

· Disadvantage: Higher short-term fluctuations create uncertainty

· Advantage: Greater potential for returns during uptrends and better opportunities for disciplined investors using systematic investment plans (SIPs)

Asset Allocation Principles: Why Gold Belongs in Portfolios

The Time-Tested 60-30-10 Framework

Financial experts widely recommend the following portfolio allocation framework:[3][1]

60% Equities

· Growth driver for long-term wealth accumulation

· Provides dividend income and capital appreciation

· Equity exposure for 20-30 year investment horizons

30% Debt

· Stability and predictable returns

· Tax-efficient fixed-income instruments (government securities, bonds)

· Emergency liquidity maintenance

10% Commodities (Primarily Gold)

· Diversification from equity and debt assets

· Inflation hedge and safe-haven protection

· Inverse correlation with equities during market stress

This allocation principle has proven its worth over the 2015-2025 decade, as demonstrated by the strong gold performance during periods when equity volatility increased.

Why Gold Provides Unique Benefits

Inflation Hedge:

Gold's purchasing power preservation makes it invaluable during inflationary periods. As the Indian Rupee value declined and inflation pressures mounted, gold provided crucial protection for investors.[12][13]

Negative Correlation with Equities:

Gold historically demonstrates inverse correlation with stock markets, meaning it often rises when equities decline. During the 2020 COVID crash and other market corrections, gold provided portfolio stability.[4][3]

Geopolitical Risk Protection:

During periods of international tension, conflict, or political uncertainty, gold serves as a safe haven that investors flock to, driving price appreciation when other assets struggle.[7][1]

Currency Hedge:

Gold's international pricing in US dollars provides natural protection against Rupee depreciation, making it valuable for investors concerned about currency volatility.[8]

financial planning pyramid of Wealth Protection, Creation ...

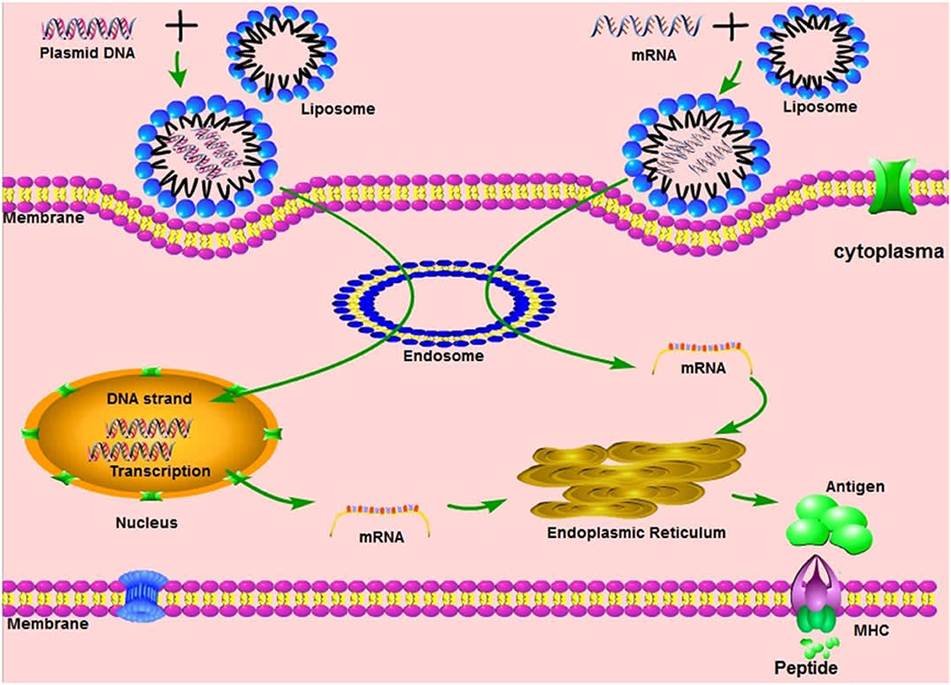

Investment Options: Physical Gold vs. ETFs vs. SGBs

Physical Gold: Traditional But Cumbersome

Advantages:

· Direct ownership and tangible possession

· No counterparty risk

· Psychological satisfaction and cultural significance

Disadvantages:

· Storage and security costs (lockers, vaults, insurance)

· Making charges and purity verification costs

· Illiquidity and difficulty in small quantity sales

· Capital gains taxation complexity

Gold ETFs: The Modern Approach

· Liquidity: Can be bought and sold instantly during market hours like stocks

· No Storage Costs: No need for lockers or insurance

· Lower Costs: Minimal expense ratios (0.5-1.5% annually)

· Flexibility: Can invest small amounts systematically through SIPs

· Transparency: NAV publicly available, tracking physical gold prices accurately

· Tax Efficiency: Capital gains taxation similar to other financial assets

Key Gold ETFs in India:

· Motilal Oswal Gold ETF

· Aditya Birla Gold ETF

· ICICI Prudential Gold ETF

· HDFC Gold ETF

· Axis Gold ETF

Sovereign Gold Bonds (SGBs): Government-Backed Option

Unique Features:[9]

· Fixed Interest: 2.5% annual interest on gold value (unique to SGBs)

· Tax Benefits: Capital gains exemption if held until maturity (typically 8 years)

· Government Backed: Direct RBI liability, zero credit risk

· Liquidity: Can be traded on secondary market or redeemed at maturity

· Unit Size: Issued in multiples of 1 gram minimum

SGB vs. ETF Comparison:

|

Feature |

Gold ETF |

Sovereign Gold Bond |

|

Liquidity |

Excellent (daily trading) |

Good (monthly/secondary market) |

|

Interest Income |

None (only capital appreciation) |

2.5% annual fixed |

|

Tax Efficiency |

Standard capital gains |

Exemption if held 8 years |

|

Expense Ratio |

0.5-1.5% annually |

Minimal after issuance |

|

Storage |

No cost |

No cost |

|

Maturity Benefits |

None (perpetual holding) |

Redeemable at maturity |

Recommendation for Most Investors: Gold ETFs offer superior liquidity and flexibility, making them ideal for systematic SIP-based investing, while SGBs are better for investors with specific 8-year investment horizons who value the fixed interest component.

Systematic Investment Plan (SIP) Strategy for Gold

Rupee-Cost Averaging Advantage:[14]

A disciplined Gold SIP investment strategy through mutual funds or ETFs offers significant advantages:

· Automatic Purchase: Fixed monthly amount automatically invests in gold

· Lower Average Cost: Buy more units when prices are low, fewer when prices are high

· Discipline: Removes emotional decision-making from investments

· Compound Growth: Regular investments compound significantly over 10-15 year periods

Recommended Gold SIP Allocation

For ₹50 Lakh Portfolio:[15]

· 10% to Gold: ₹5 lakh allocation

· Monthly SIP Approach: ₹5,000/month for 100 months (8.3 years)

· Remaining Allocation: ₹45 lakh split between equities (60%) and debt (30%)

For Individual Investors:

Start with ₹2,000-5,000 monthly SIP in gold ETFs, adjusting amounts based on:

· Overall portfolio size

· Risk tolerance

· Investment timeline

· Financial goals

Historical SIP Performance Validation

If an investor had started a monthly SIP in gold from January 2015 to December 2025 (121 months), investing a constant ₹10,000 per month:

· Total Investment: ₹12,10,000

· Average Gold Price During Period: ~₹65,000/10grams (midpoint)

· Expected Current Value: ~₹34-36 lakh

· Total Returns: 180-200% (significantly lower than lump sum, but still exceptional)

This demonstrates that even through systematic investing, gold has delivered outstanding returns compared to typical financial instruments.

The Importance of Gold in a Diversified Investment Portfolio ...

2026 Gold Outlook: Expert Predictions and Market Drivers

Gold is expected to maintain its bullish trajectory in 2026 with:

· 2026 Target: ₹1,50,000 per 10 grams (upside potential of 10-12% from current levels)

· International Target: Near $4,820 per troy ounce

· Downside Support: $3,420 per troy ounce (approximately ₹2,80,000 per kg)

Longer-Term Predictions:[5]

Market analysts project continuing gold price appreciation based on:

|

Year |

Projected Gold Price (₹/10gm) |

|

2026 |

₹1,50,000 |

|

2027 |

₹1,57,500 |

|

2028 |

₹1,68,500 |

|

2029 |

₹1,80,000+ |

Fundamental Drivers Supporting Higher Prices

Structural Support Factors:[1]

1. Central Bank Accumulation: Global central banks continue to diversify away from dollar holdings into gold, providing ongoing institutional demand

2. Geopolitical Tensions: Regional conflicts and international tensions maintain safe-haven demand

3. Currency Concerns: Potential further Rupee depreciation against the dollar drives domestic demand

4. Inflation Persistence: Despite rate hikes, inflation remains above historical averages, maintaining gold's appeal

5. ETF Inflows: Continued institutional and retail investment through ETF channels

Caution Points and Correction Risks

Potential Headwinds:[1]

While the outlook remains positive, investors should be aware of correction risks:

· Rising Real Interest Rates: If Fed maintains higher rates longer, gold may face headwinds

· Strengthening US Dollar: A strong dollar typically pressures gold prices globally

· Risk Sentiment Improvement: Significant improvement in global risk sentiment could shift investors away from safe-haven assets

· ETF Reversals: Large redemptions from gold ETFs could trigger temporary corrections

Correction Scenarios:[1]

· Minor Correction: 5-8% decline to ₹1,25,000-1,30,000/10gm (buying opportunity)

· Significant Correction: 15-20% decline to $3,400-3,500/oz (₹1,10,000-1,15,000/10gm)

Expert opinion suggests that even with corrections, the long-term uptrend remains intact, and corrections should be viewed as accumulation opportunities for systematic investors.

Portfolio Construction: Integrating Gold for Optimal Returns

Sample Portfolio for Different Investor Profiles

Conservative Investor (Low Risk Tolerance):

· Equities: 40%

· Debt/Fixed Income: 50%

· Gold: 10%

· Expected Return: 8-10% annually

· Primary Benefit: Capital preservation with modest growth

Balanced Investor (Moderate Risk Tolerance):

· Equities: 60%

· Debt/Fixed Income: 30%

· Gold: 10%

· Expected Return: 12-14% annually

· Primary Benefit: Growth with stability and diversification

Aggressive Investor (High Risk Tolerance):

· Equities: 70%

· Debt/Fixed Income: 15%

· Gold: 15%

· Expected Return: 14-16% annually

· Primary Benefit: Maximum growth with inflation and geopolitical hedges

Retiree/Income-Focused Investor:

· Equities: 30%

· Debt/Fixed Income: 50%

· Gold: 10%

· REITs/Others: 10%

· Expected Return: 7-9% annually

· Primary Benefit: Stable income with capital protection

Annual Rebalancing Recommendation:[15][3]

· Review portfolio allocation every 12 months

· If gold allocation drifts beyond 10-15% range due to price appreciation, rebalance back to target

· Use rebalancing as discipline to lock in gains and reallocate to underperforming assets

Example: If gold appreciates from 10% to 15% of portfolio, sell gold to bring it back to 10% and reinvest proceeds in equities or debt.

FAQs: Common Questions About Gold Investment

Q: Should I invest in gold now at near all-time highs?

A: Yes, if you're following a systematic SIP approach or have a long investment horizon (10+ years). Gold's fundamental drivers remain intact, and corrections can be viewed as accumulation opportunities.

Q: Is gold still worth investing after 430% returns?

A: Gold has delivered exceptional returns but remains fundamentally sound for diversification. Expert projections suggest 10-12% upside potential in 2026, with long-term support for 5-15% allocations.

Q: Should I buy physical gold or gold ETFs?

A: Gold ETFs are recommended for most investors due to liquidity, lower costs, and ease of SIP investing. Physical gold suits those wanting direct ownership and cultural/sentimental reasons.

Q: What's the tax treatment of gold investments?

A: Capital gains are taxed as follows:

· Short-term (< 2 years): Added to income, taxed at applicable slab rate

· Long-term (> 2 years): 20% tax with indexation benefit (inflation adjustment)

· SGBs: Capital gains exempt if held until maturity (8 years)

Q: How much gold should I own?

A: Financial advisors recommend 10-15% of total portfolio allocation to gold, depending on risk tolerance and investment goals.

Q: Can gold prices fall significantly?

A: Yes, gold can experience corrections of 15-20% during risk sentiment improvements. However, structural factors and long-term outlook remain positive, making corrections buying opportunities.

Q: What's the expected return on gold in the next 5 years?

A: Based on structural factors and analyst forecasts, gold could deliver 8-12% annualized returns, with total return potential of 40-60% over five years.

Conclusion: Gold's Validated Role in Modern Portfolios

The remarkable journey of a ₹1 lakh gold investment growing to ₹5.3 lakh over the past decade provides compelling validation for gold's role as a serious wealth-creation asset, not merely a preservation mechanism. The 430.99% return, delivering approximately 18.5% annualized gains, has conclusively demonstrated gold's ability to outperform traditional equity indices over this critical period of global economic turbulence and inflation concerns.

Key Takeaways for Investors:

1. Gold Delivers Real Returns: The past decade proves gold can create substantial wealth, challenging traditional narratives that equities always win

2. Diversification Works: Including gold in portfolios has improved risk-adjusted returns while providing protection during equity market turmoil

3. Systematic Investing Matters: SIP approaches smooth volatility and deliver compounding benefits even in volatile assets like gold

4. Multiple Investment Vehicles: Gold ETFs offer superior convenience and liquidity compared to physical gold for most modern investors

5. Long-Term Outlook Remains Positive: With structural drivers intact, gold's prospects for 2026 and beyond remain compelling

For investors constructing portfolios in 2025 and beyond, ignoring gold entirely would be imprudent, given its demonstrated ability to generate exceptional returns while serving as a crucial diversification and hedging tool. The question for prospective gold investors is no longer "Should I invest in gold?" but rather "What portion of gold exposure suits my financial goals, risk tolerance, and investment timeline?"

As the saying goes in the investment community: "Gold is the currency of confidence, and as long as uncertainty persists globally, gold will continue to shine." The past decade has proven this adage in spectacular fashion, and disciplined investors who maintain appropriate gold allocations are likely to benefit as this multi-year uptrend continues.

Post your opinion

No comments yet.